Big announcement of major investment on GREEN SAF, is it the ONE?

A team led by a venture spun off from Oxford spun and heavy weights in aircraft manufacturing and green financiers made a notable announcement (below) that they were infusing £20.75 MILLION ($28 MILLION) for sustainable aviation fuel development. The SIZE OF THE INVESTMENT, THE PROMISING TECHNOLOGY AND THE CREDIBILITY OF THE INVESTORS make this a significant milestone in the drive to 2050.

The goal of Net Zero Carbon emissions by 2050 is one of , if not the, greatest challenge for aviation. Billions have been committed by OEMs, major capital venture companies, foundations, universities, NGOs and countries. Here is a short list of blogs focused on the players, the variety of energy sources, exploring different chemical options to convert raw materials into suitable fuels, the environmental consequences of harvesting the feedstocks for SAF,the distribution for these new sources and the infrastructure needed, the capacity of CO reduction through cleaner engines, similar analyses of fuselages’ impact on emissions and even operational tactics’ which may be greener:

- Positive Prospect in HYDROGEN as an aircraft power source

- Will P&W’s addition of steam make CO emissions GREENER?

- UK says H2 has a positive prospect; France is delaying its H2 efforts- COOPERATE???

- SAF may be the solution to CONTRAILS

- Emirates’ Green Operating Procedures start with the Cockpit

- Great Report Card from EIA on SAF

- How’s H2 progressing through the Certification Track?

- FAA’s FAST awards towards the 2050 Zero Carbon Emissions Goal

- RTX test shows that SAF works and is GREEN

- SAF goal is challenging, but the Naysayers’ “Impossible” is myopic

- EASA and FAA show 1st iteration plans on H2 Certification

- EU’s aerospace research & installation plan-THREAT OR OPPORTUNITY???

- GREAT GREEN NEWS: Pittsburgh brings SAF production on airport

- Swiss Alchemy creates SAF with the SUN ???

- Uplifting Aviation Green news on Workable Nozzles for Hydrogen Combustion

- BRAZIL’S GREEN AVIATION INNOVATION’S AWARD

- Conflicting Developments in the Hydrogen Aviation Power Race

- More SAF feedstocks = cheaper green fuel?

- 2050 ZERO NET EMMISIONS; EU’s Clean Aviation and the US- HOW are they doing?

▬►to read the full text for any of these posts, click on this LINK and use the search box.

These provide some context to the 2050 goal campaign, so many different directions and with so little apparent coordination )competition better?). In this universe SAF is but one option and it is not without possible problems and doubters.

SO WHY TOUTING THIS OXFORD PRESS RELEASE AS SIGNIFICANT?

An excellent assessment of SAF has been published by ICCTO20, Why and how to bring down the cost of SAF. The OXCCU “solution” seems to meet the ICCTO20 identified impediments-

COMPARATIVE PRICE-“European Union Aviation Safety Agency estimated that the average production cost of SAF in 2024 ranged from €1,461 per tonne (for biofuels) to €7,695 per tonne (for e-fuels). We calculate that this is a cost premium of 2.1–10.6x compared with fossil jet fuel by converting fossil jet production costs from the International Energy Agency, reported in U.S. dollars per liter, into equivalent units. While e-fuel costs should come down when they arrive on the market around 2030, they are expected to remain far above the current price of fossil jet fuel.”

- The Oxford production technology looks to be a cost effective method for refining

RISK OF INVESTMENT—“It takes up to 5 years for SAF projects to reach final investment decision—a critical stage during project development that indicates whether projects are ready to move forward to construction—and many projects fail before this is achieved. Earlier this year, consulting group BCG found that fewer than 30% of SAF projects globally have reached final investment decision. Often projects come apart due to technology “valleys of death” during the transition between the demonstration and commercialization stages. This can be the result of poor project financing, mismanagement, or unforeseen technical barriers. SAF projects require significant funding and investor backing, particularly when constructing first-of-a-kind (FOAK) facilities.

If funding support fluctuates (as it has with the recently revised 45Z tax credits in the United States), if producers cannot secure long-term offtake agreements, or if governments and other investors do not provide sufficient loan support, SAF projects may fail before final investment decision.

- OXCCU has attracted an uber impressive investment team which has a gravitas by including

- a consortium of airlines, likely excellent judges of the prices and the practical implementation issues;

- a major OEM that knows how its powerplants and systems emit carbon plus what their machinery ingests a range of potential fuels

- six financial institutions that already participate in the green energy sector and thus have insights into OXCCU’s competitors

As noted green investor, celebrated baseball player and manager, Yogi Berra[1] once opined that…

As good as the OXCCU prospects appear to be, innovation, technology, market prices and a whole host of “unknown/unknowns” may not reward the BLUES’s green solution.

Airlines and Safran Back New SAF Production Process

A Series B funding round raised $28 million for the Oxford University start-up

UK start-up OXCCU is preparing to start demonstrating its new SAF production process in a larger plant at Oxford Airport.

By Charles Alcock • Managing Editor

September 30, 2025

International Airlines Group and aircraft engines and systems group Safran are among the main investors in the Series B funding round that raised £20.75 million ($28 million) for sustainable aviation fuel innovator OXCCU. The capital will support development of the UK start-up’s OX2 fuel manufacturing demonstration plant located at Oxford Airport, which is expected to be fully operational in 2026.

OXCCU is developing a process to support mass production of sustainable aviation fuel (SAF) by converting biogenic waste carbon and hydrogen by the end of the 2020s. The company, which was founded by Oxford University chemical engineers in 2021, is already producing small quantities of its SAF blend in the smaller OX1 demonstration plant.

In addition to the IAGi Ventures arm of International Airlines Group (parent company of British Airways and Iberia) and Safran Corporate Ventures, the latest funding round was also backed by new investors Orlen VC, Hostplus, and TCVC. The oversubscribed round was supported by existing backers including Clean Energy Ventures, IP Group/Kiko Ventures, Aramco Ventures, Eni Next, and Braavos Capital.

“In a market where capital is tight and investors are rightly selective, this raise is a testament to the strength of our science, the clarity of our mission, and the urgency of the problem we’re solving,” said Andrew Symes, OXCCU’s CEO. “What we’re seeing is that serious players with truly distinctive technologies are still getting funded.”

Simplified, Lower-cost SAF Production

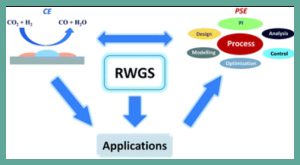

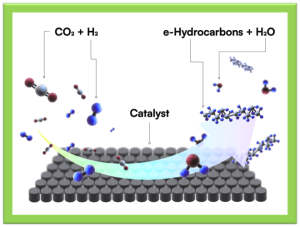

According to OXCCU, its approach simplifies SAF production by eliminating the need for reverse water gas shift or e-methanol steps. Instead, its patented iron-based catalyst enables the direct synthesis of jet-fuel-range hydrocarbons from gaseous waste carbon in a single exothermic reaction.

The company claims that this process reduces capital and operating costs, as well as the carbon intensity of the fuel. The catalyst can be applied with a wide range of carbon dioxide, carbon monoxide, and hydrogen input gas compositions, which is expected to deliver the flexibility to efficiently convert different feedstocks such as reformed biogas, gasified wood waste, and pure carbon dioxide with hydrogen.

OXCCU says its catalyst will produce sustainable aviation fuel in a simpler and lower-cost process.

“We recognize the need for the world to achieve net-zero emissions by 2050 and for the aviation sector to play its part and to develop sustainably,” commented Jonathon Counsell, IAG’s group sustainability director. “IAG has been a leader in the sector, being the first airline group globally to commit to net zero by 2050. We are further committed to our goal of meeting 10% of our fuel needs with SAF by 2030. Meeting these goals will be supported by this investment into OXCCU, which is part of our strategy of developing new partnerships to produce next-generation fuels.”

[1] There is much debate whether this Yankee originated this phrase. Not the least of which it is highly likely that he ever attended or remained awake all the way the performance by Brunnhilde in Richard Wagner’s Götterdämmerung, the last of the immensely long, four-opera Ring Cycle.