Aircraft Maintenance Shortage- what the FAA is doing?

The debate rages on about whether there is a pilot shortage. All of the experts agree that the aircraft maintenance technician (AMT) supply is short-immediately, plus to/through 2034. The projected deficit is attributable, according to the below WINGS article, to retirements, impact of COVID defections, and the incoming flow of AMT graduates is inadequate. This squeeze is exacerbated by the current cadre of MX staff is not as experienced.

The new aircraft sales are increasing, but in the near term, Boeing’s FAA restricted production is forcing the airlines to extend the lives of their fleets. QA/QC issues have surfaced among the carriers necessitating greater care in their hangar output.

There are 28 FAA certificated ATM schools (14 CFR Part 147) and their required curriculum was recently modernized. The Certificate (Airframe [A] or Powerplant [P] or A&P) costs around $40,000 in tuition and may require as many as 1,900 hours to complete the Part 147 training.

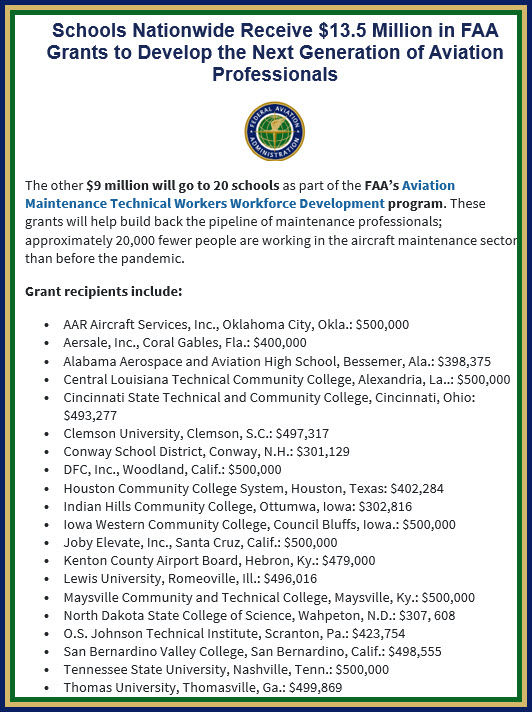

Congress acknowledged this problem and authorized the FAA’s Aviation Maintenance Technical Workers Workforce Development program. As detailed below, the agency has made grants for “aviation maintenance technical workers support proposals that generate and increase interest and prepare students to pursue aviation maintenance careers” in its third round of such awards. Hopefully these funds will stimulate students to enter this profession and most importantly result in a wave of well qualified AMTs.

++++++++++++++++

Maintenance staff shortage could clip aviation industry’s wings

World | 31 Mar 2024 2:35 pm

The United States is grappling with a SHORTAGE OF MAINTENANCE WORKERS in the aviation industry, with baby boomers retiring and others changing jobs during the pandemic.

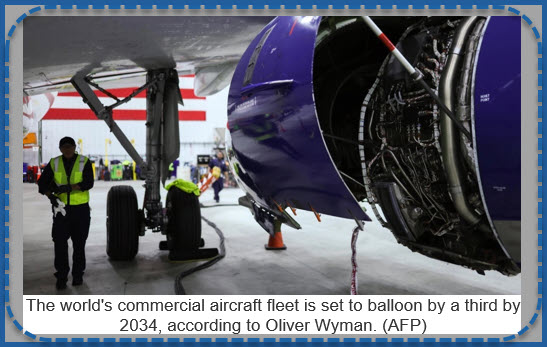

This comes as the global fleet of commercial aircraft is set to balloon a third by 2034, involving more than 36,400 vessels, according to a recent study by consulting firm Oliver Wyman.

In its wake, spending in the maintenance, REPAIR AND OVERHAUL MARKET IS PROJECTED TO GROW ALMOST 20 PERCENT BY 2034.

But the sector suffers from a shortfall of qualified manpower — and an inadequate pipeline of talent.

It LACKS SOME 24,000 AVIATION MAINTENANCE TECHNICIANS in North America, a figure due to reach nearly 40,000 by 2028, Oliver Wyman notes.

This gap is not one that the renowned Aviation High School in Long Island will be able to fill with its cohorts totaling 2,000 students.

…

The school is one of 28 certified by the US Federal Aviation Administration (FAA), and trains future aviation maintenance technicians who can either enter the workforce after high school or further their studies in universities.

“The job market is good and there is more money so, at the moment, more go straight to work than before,” Jackson told AFP.

In the United States, around 4,000 maintenance, repair and overhaul companies employ some 185,000 aviation maintenance technicians and engineers. This forms around 44 percent of the global total, according to the AERONAUTICAL REPAIR STATION ASSOCIATION.

…

AlixPartners specialist Pascal Fabre stresses that the training of maintenance technicians will need to be accelerated.

To boost the attractiveness of aviation maintenance, Congress passed legislation in 2018 enabling the FAA to provide ad hoc grants.

As a result, $13.5 million was awarded in March to 32 schools, 20 of which would especially help with training maintenance professionals.

“Because so many aviation jobs are critical to operations, any ongoing shortage can eventually result in the industry’s growth being limited,” Oliver Wyman noted in an earlier report.

In a 2023-2042 outlook, aviation giant Boeing forecasts “strong” long-term demand for newly qualified aviation personnel.

There is a need for SOME 690,000 NEW MAINTENANCE TECHNICIANS to help maintain the global commercial fleet over the next 20 years, according to Boeing.

The maintenance, repair and overhaul sector is “under-capacity, and hangar maintenance slots are in high demand, especially as aircraft manufacturers’ delivery delays mean that older aircrafts are being flown for longer periods, requiring more maintenance,” Fabre added.

The two major aircraft manufacturers, Boeing and Airbus, are fully booked until almost the end of the decade and are accumulating delays.

Meanwhile, airlines are stepping up orders as they seek to capitalize on strong demand from travelers and build fuel-efficient fleets.

“The pressure to produce and the retirement of many skilled baby boomers during COVID may also be contributing to some of the quality-control issues plaguing the industry,” the recent Oliver Wyman report added.

According to experts, departures have led to the disruption of a transfer of know-how between experienced and new technicians.

Since 2023, Boeing has suffered production problems and numerous incidents on its 737 MAX series, which prompted the FAA to launch an audit into its quality control.

In early January, an Alaska Airlines 737 MAX 9 suffered a blowout of a door plug while in flight.

Boeing CEO Dave Calhoun recently announced that he would step down by year-end, in a leadership shakeup as the company faces heavy scrutiny.

Previously, two fatal 737 MAX crashes — one in 2018 and one in 2019 — led to a nearly two-year grounding of the aircraft.

Beyond manufacturers, United Airlines is also in the crosshairs of the FAA, which is reviewing its safety procedures after several recent incidents.

+++++++++++++++++++++++++