The 1sts in line for FAA eVTOL TC have advantages, but 2nds will have important +++s

![]() has published the below, excellent review of the progress of the leading eVTOL developers, citing all of the milestones that they have achieved in 2025. Also, Jack Daleo, the author, works through all of the regulatory actions taken by the White House, President Trump’s DoT Secretary and the FAA to facilitate the processing of the TC applications, mentioning both the “Unleashing American Drone Dominance” program, and the eVTOL Integration Pilot Program. The article justifiably leaves an impression that the 4 named eVTOL competitors will soon cross the line allowing them to operate their innovative aircraft. Likely they will.

has published the below, excellent review of the progress of the leading eVTOL developers, citing all of the milestones that they have achieved in 2025. Also, Jack Daleo, the author, works through all of the regulatory actions taken by the White House, President Trump’s DoT Secretary and the FAA to facilitate the processing of the TC applications, mentioning both the “Unleashing American Drone Dominance” program, and the eVTOL Integration Pilot Program. The article justifiably leaves an impression that the 4 named eVTOL competitors will soon cross the line allowing them to operate their innovative aircraft. Likely they will.

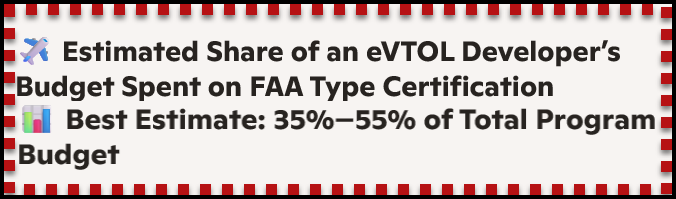

The financial investment to design, engineer, develop the manufacturing capabilities AND THEN TO MEET THE BURDENS OF PROOF REQUIRED TO EARN A TYPE CERTIFICATE is immense. Analysis of available data shows that 35-50% of the developers’ costs are devoted to proving the aircraft’s airworthiness. The same sources break down the individual costs

as follows—

The benefits of first to market add to the likely price of the aircraft to be sold. The FAA’s Guidance[1] for achieving its Good Housekeeping seal of approval was written in PERFORMANCE TERMS (not prescriptive) so as to encourage innovation

That’s the good news. The bad news is that there is no predefined path to the goal. Under this performance approach (different from EASA’s prescriptive regimen) the FAA will establish custom certification bases from existing airworthiness standards (e.g., Part 23, Part 27) fitted to each applicant’s unique designs. Some of the variations in the competitors’ likely designs, manufacturing and the like include:

- Some OEMs (e.g., Joby) vertically integrate, reducing supplier certification costs

- Others (e.g., Lilium) rely on more complex architectures, increasing certification burden

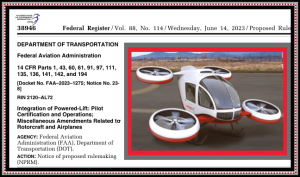

- Battery safety requirements can swing costs dramatically

- EARLY ENTRANTS PAY A “FIRST‑OF‑TYPE” PENALTY THAT LATER OEMS MAY AVOID ç

By not being the 1st in line for certification, as the FAA makes public its certification approach with real cases, the second group of developers will learn from that track.

With SMEs who will watch and learn from these experiences, the next wave of eVTOL entrepreneurs may be able to avoid some of the time and dollars association with the above breakdown. Public documents indicate that Joby, Archer, and Lilium each project $1.0–1.5B total development cost to certification. Those avoided dollars usually translate to more attractive price points for their aircraft. Low sticker prices lead to greater sales.

total development cost to certification. Those avoided dollars usually translate to more attractive price points for their aircraft. Low sticker prices lead to greater sales.

2025: A Big Year for Electric Air Taxi Testing, But 2026 Will Be Bigger

Electric air taxis and other novel aircraft are expected to participate in operational trials as soon as summer 2026.

Electric air taxis and other novel aircraft are expected to participate in operational trials as soon as summer 2026.

The FAA in October 2024 published a special federal aviation regulation (SFAR) with seismic implications for the aviation industry—a framework for the early integration of electric vertical takeoff and landing (eVTOL) aircraft.

As 2026 begins, these new entrants, capable of both vertical lift and wingborne flight, may be months or even weeks away from flying in a city near you.

Electric air taxi manufacturers JOBY AVIATION, ARCHER AVIATION, and BETA TECHNOLOGIES believe they are nearing TYPE INSPECTION AUTHORIZATION (TIA) testing—a critical phase of the type certification process during which FAA test pilots evaluate the aircraft. Boeing’s Wisk Aero, which in December completed the first flight of its autonomous Generation 6 air taxi, is not far behind them.

Wisk Aero, which in December completed the first flight of its autonomous Generation 6 air taxi, is not far behind them.

But before TIA, these manufacturers may have an opportunity to fly aircraft in real-world settings—with real infrastructure and airport personnel—should they be selected for the eVTOL Integration Pilot Program (eIPP).

The eIPP, unveiled in September, will run for three years and comprise at least five projects. According to the FAA, eIPP participants may even be able to conduct operations for revenue—something they are unable to do under existing flight test and market survey programs.

But before we look ahead to 2026, let’s recap the most active year in electric air taxi flight testing so far.

New Highs in 2025

The past year saw several electric air taxi developers hit key milestones and perform more real-world testing than ever before.

Beta Hits 100,000 Miles

None were as visible as Beta, which conducted public demonstrations with its Alia conventional takeoff and landing (CTOL) at airports across the U.S. and Europe.

Beta surpassed 100,000 nm across its test aircraft in 2025, most of them with the Alia CTOL. But many of the design’s features—including its proprietary H500A engine—are shared by the vertical takeoff and landing (VTOL) variant of Alia, which the company aims to certify about one year later. It has assembled conforming motors that are undergoing for-credit testing and will soon be installed on TIA- and eIPP-ready aircraft.

Beta CEO Kyle Clark said last year’s highlight was flights into the highly controlled airspace of John F. Kennedy International Airport (KJFK), Hartsfield-Jackson Atlanta International Airport (KATL), and Le Bourget Airport (LFPB) in France, where FLYING watched Alia’s opening demonstration at last year’s Paris Air Show.

During those flights, Clark said the aircraft coordinated with air traffic controllers and other airport personnel, as well as FBOs and ground systems.

“These are places where you have to absolutely know your energy, your reserve requirements, and your reserves,” said Clark. “You have to have really good communications, which means there can’t be any static. The radios have to be sharp. They give you one chance to get your instructions right.”

Beta has also gotten the CTOL in the hands of intended customers such as Bristow Group, UPS, and Air New Zealand. Clark said one Air New Zealand pilot even used Alia to complete a commercial check ride at the company’s Vermont training center.

“It’s a whole ‘nother maturity step to hand your baby off to somebody else to fly,” he said.

Beta’s Alia VTOL flew less than the CTOL in 2025. But the year prior, it achieved a piloted transition from hover to forward flight—the defining feature that separates VTOL designs from the rest.

Joby Makes the Transition

Joby achieved its first piloted transition in 2025, which chief test pilot James “Buddy” Denham said in December marked “the most extensive and rigorous flight testing in our history.”

The company’s aircraft covered about 9,000 miles across more than 850 flights last year, which it said dwarfed 2024. Many flights included piloted transitions. The company also threw the air taxi some curveballs, such as disabling propellers to gauge how it handles contingencies.

Among the flights were public demonstrations at Japan’s Fuji Speedway and the 2025 World Expo in Osaka. Joby also flew during the Dubai Airshow following months of testing in the deserts of the United Arab Emirates, during which it completed the UAE’s first piloted, point-to-point eVTOL flight.

Before that, the air taxi flew between Marina Municipal Airport (KOAR) and Salinas Municipal Airport (KSNS) at the California International Airshow, and between Marina and Monterey Regional Airport (KMRY) in August.

Joby also conducted the maiden flight of a hybrid-electric variant in November, just three months after announcing the concept. Over the summer, it logged 7,000 miles on a Cessna 208B Grand Caravan equipped with its Superpilot autonomy system.

Archer Reaches New Heights

Archer had been conducting autonomous testing until June, when it reached a milestone of its own—the start of piloted flight testing.

Pilots were able to take the company’s Midnight to new heights, achieving a record altitude of 10,000 feet in September. The air taxi also completed a 55-mile flight—shy of its intended top range of 100 miles but squarely within the 20-50-mile bracket that Archer considers optimal for Midnight trips in cities, such as New York and Los Angeles.

Midnight also made its first international flights in the UAE, conducting testing near Abu Dhabi’s Al Ain Airport (OMAL). Like Joby’s S4, it too flew during the California International Airshow.

Wisk Finally Lifts Off

Wisk—which unlike its competitors will field an autonomous aircraft at launch—is operating on a slightly different timeline. But the company for the first time in December flew what it described as a “test article” of the Generation 6 it plans to certify.

The untethered hover flight included some limited forward movement and lasted about one minute, following a predetermined flight plan.

Wisk said the milestone followed rigorous testing with a software-equipped iron bird rig, which it uses to gauge performance in a range of simulated conditions. The company also conducted restrained ground testing, ensuring all systems and components functioned under pressure at 100 percent torque.

Why 2026 Could Be Even Bigger

Electric air taxi manufacturers completed plenty of internal testing in 2025. Starting this year, they have the opportunity to see how that testing translates to real-world performance.

Ready for Liftoff

The eIPP is expected to begin within 90 days of participant selection, which is anticipated in March. The trials will adhere to FAA regulations. But the agency will allow participants to conduct operations not normally permitted with precertified aircraft.

Certain cargo operations, for example, will be able to generate revenue “under specific circumstances” and on a “case-by-case basis,” per the FAA. Participants will be allowed to use temporary infrastructure, though they will need to foot the bill themselves.

Specific requirements, such as data reporting and the number of flight hours and demonstrations, will be set during the contract award process.

“We’ve done the demonstrations, and now we’re ready to take it to the next phase with those sustained operations,” said Kristen Costello, head of government and regulatory affairs for Beta.

Costello said many of Alia’s flight hours are international, and Beta’s market survey program does not allow it to study the economics of the company’s operation. That could change with the eIPP.

“The eIPP allows us to do this domestically at a larger scale, get more data, and—for cargo logistics and medical applications—do it for revenue,” Costello said.

Clark said that Beta has a “very large number” of eIPP proposals. The company plans to begin with cargo operations in the Alia CTOL before advancing to passenger flights with the VTOL.

Archer in December said it submitted eIPP applications with cities in California, Texas, Florida, Georgia, and New York. It was the sole manufacturer to apply with the city of Huntington Beach, California—just a few miles from Hawthorne Municipal Airport (KHHR), which it is in the process of acquiring from the city of Hawthorne.

Joby in September said it was working on applications with partners in Texas, Florida, Ohio, New York, and California for both passenger and cargo eIPP projects.

Wisk told FLYING that the Gen 6 that flew in December will perform autonomous operations under the program.

The Big Test

During eIPP testing, several air taxi developers expect to advance to TIA.

Costello described the process as A “NEGOTIATION” WITH THE FAA, which will give the green light to move forward after accepting all compliance planning documents. She said that some—but not all—of Beta’s flight test plans have been validated. She added that FAA pilots make quarterly visits to its facilities, conducting human factors assessments within Alia’s cockpit.

Clark said Beta is testing aircraft that are “identical” to those that will enter TIA, using the requirements the FAA has defined as a guide. The company is also racking up flight hours on its H500A engine.

“While we’re developing this engine, we happen to have this aircraft that we can put it on to go fly it around and pull in all of that data,” said Costello.

Clark said Beta will use the pre-TIA period to iron out the kinks with Alia. For example, it replaced a faulty seal and modified the way ice sticks to the aircraft’s hinges.

“If you have to make those changes after TIA, it takes a lot more paperwork and a lot more time,” he said. “So this is a big accelerant to an expeditious certification program.”

Archer said in August that it is building six conforming aircraft, with three in final assembly. Some are intended for TIA.

Joby too is preparing for the big test. It started production of conforming propeller blades in October and powered on its first conforming aircraft in November.

“We continue to plan for this aircraft to take to the skies later this year, flown by Joby pilots, clearing the way for FAA pilots to start for-credit testing next year,” Joby CEO JoeBen Bevirt said in November.

What Else Is New?

The coming year could see eVTOL manufacturers test even more autonomy and hybrid-electric propulsion.

Wisk plans to continue hover and low-speed stability testing with the Gen 6 before expanding the envelope. It will gradually increase speed and altitude, sprinkling in maneuvers like pedal turns at low speed.

Wisk believes it can achieve a transition flight in the next six months. The company is building a second Gen 6 that it expects to fly later this year.

Collaborations between Joby and L3Harris, Archer and Anduril, and Beta and GE Aerospace also seek to explore these technologies. Joby and Archer, for example, plan to deploy NVIDIA’S IGX THOR INTELLIGENCE PLATFORM.

2026 could even see some new entrants. Honda, for example, recently applied for an FAA exemption in hopes of flying its first eVTOL demonstrator in March.

ONE THING IS FOR CERTAIN: THE U.S. GOVERNMENT IS BEHIND THESE MANUFACTURERS.

A White House executive order, tellingly titled “Unleashing American Drone Dominance,” created the eIPP in June. A few months later, the Transportation Department released the Advanced Air Mobility National Strategy—a whole-of-government blueprint to accelerate eVTOL testing and adoption.

“Our next goal is a million [miles],” said Clark. “We’re going to build more airplanes, we’re going to fly more often, and we’re going to get all that data.”

[1] 14 CFR § 21.17(b); Advisory Circular (AC) 21.17-4