Eight Aviation Safety Predictions for 2026– add to. argue against or just comment–last time available for 2025

2025 was a year of a number of major breakthroughs and unfortunately too many breakdowns. Were these events incursion points that catalyzed positive changes? Or will aviation still struggle with regaining a good course? No Nostradamus here; so, research identified some trends that may shape 2026 as aviation’s trajectory.

In no particular order, a list of WAGs that we might see in the following 8760 minutes:

- 2025 BREAKDOWN– Newark outages ATC modernization—this event raised the awareness of the public, the Congress and Administration that 30+years of NextGen expenditures had gone for naught. Curiously, over those 3 decades, no Hill hearings “discovered” the deficiencies {double entendre OVERSIGHT}.

-

-

- Analysis of ATC problem- A people – President Trump’s[1] DOT Secretary announced the “Air Traffic Controller Hiring Supercharge” promising these timeline improvements: Hiring Process Streamlined; Training Acceleration; Salary Incentives. Sec. Duffy aimed to hire 2,000 new controllers in 2025. While over 8,320 candidates were qualified and referred to the aptitude exam during the March hiring window, the number of candidates who successfully entered the FAA Academy was lower than projected. Officials acknowledged that despite streamlining the hiring process and offering incentives, medical and security clearance delays and facility assignment bottlenecks limited throughput. The bad publicity surrounding the Federal Work Stoppage did not help.

- 2026 ATC problem PREDICTION– more incentives will be added, a television recruiting ad campaign will be mounted and a smaller increase of graduated will add some of the workforce. The biggest gain will be the result of the “incentives” for recruits will be applied to retain existing controllers. Controllers may retire earlier under special FERS provisions (e.g., age 50 with 20 years of service); so, the retention package may retain a substantial number of qualified controllers able to retire under FERS.

- WHOPPER A PREDICTION: the Secretary will exempt incumbent controllers from the existing age 56 mandatory retirement.

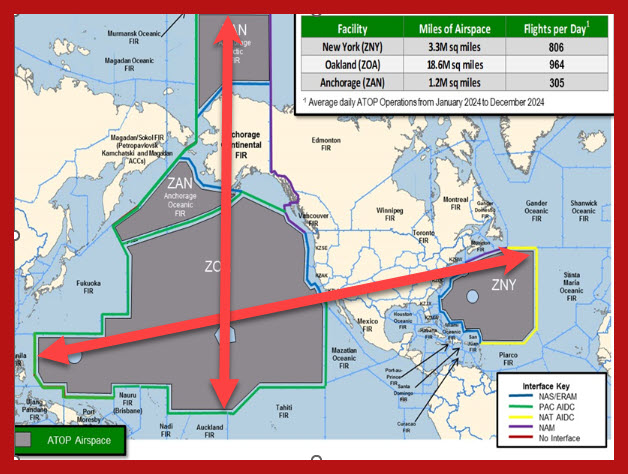

- Analysis of ATC problem- B technology The President’s DoT Secretary on May 8, 2025, announced his “Brand New, State‑of‑the‑Art Air Traffic Control System” (BNATC) initiative. He pledged to replace the entire aging U.S. air traffic control system—technology, facilities, and infrastructure—with a modern, fully rebuilt system designed to: Enhance safety; Reduce outages and delays; Replace 1970s–80s‑era technology; Support future aviation (AAM, drones, space integration); Build six new ATC centers and 15 new towers; Replace 618 aging radars; Install 25,000 new radios and 475 new voice switches; Transition the FAA from TDM to full Internet Protocol networking; Create a common automation platform across towers, TRACONs, and centers. Duffy described it as a “once‑in‑a‑generation rebuild” and said the current system is “not worth saving”. PERATON was selected on December 4, 2025, as the Prime Integrator for the FAA’s BNATC system modernization program. #47’s DoT Secretary said “We are thrilled to be working with Peraton…”

- 2026 ATC B technology problem- PREDICTION—Peraton was selected for its highly-skilled, dedicated, and talented team of engineers, technologists, and mission experts stands ready to meet, if not exceed, the BNATC contract terms. The DoT found that Peraton has a long track record of bringing the very best technological solutions, including the latest in artificial intelligence, to the most complex, high-consequence challenges facing our nation. The DoT’s selection reflected a predisposition to find a bidder that did not have the burden of past ATC work; they attributed past NextGen failures to a “same old” thinking and a reluctance to design and implement new solutions. PERATON’s performance will impress the industry (airlines, GA and BA), the controllers and the FAA with its state-of-the-art/forward-thinking solutions. Typical glitches may not exceed the Trump Administration publicly stated expectation, but the foundation implemented in 2026 will set a new paradigm for global ATC.

-

-

-

- Analysis of 2026 ATC C governance problem– Privatization or Corporatization have challenged the aviation industry for more time than makes sense. It is almost intuitive to recognize that the ATC system delivers a critical service from one end of the National Airspace to another. It is a service that is provided 24/7/365 without regard to the Congress’ erratic funding history. Business decisions, like whether a ARTCC should be located in Congression District #1or #2/ State A or B, should be made on strict parameters—SAFETY, safety & safety, plus efficiency of the facility’s operation. The ATC must be managed by competent executives with the internal personnel recognize that (i) it is a good decision and (ii) the executive will be in office for a long time (bureaucratic delay will not avoid the decision). These and a number of relevant considerations strongly recommend that the future ATC be housed in a non-profit or federal corporation.

- The impediment has been over GOVERNANCE. The largest users should have, they argue, more control in design of, operation of and charges for this system. BA and GA fear with more than a bit of rational concern that the airlines will use their votes in their insular interests. For example, the mantra for costing of ATC charges is the simplistic “a blip is a blip” is based on the equating all ATC movements without regard to the time of day and dedicated infrastructure associated with an air field– think ATL or ORD with arrivals/departures of between 150 and 200 a peak hour v. TEB, an exceptionally busy BA/GA airport that handles less that 500 operations in a day.

- Prediction of 2026 ATC C governance problem Unless some mechanism to fairly balance the decisions among the differing interest, PRIVATIZATION OR CORPORATIZATION WILL NOT HAPPEN IN 2026!!!

- Add to this corporate calculus–the introduction of personal and BUSINESS AAM vehicles in the NAS- likelihood of resolution is diminished over the next 12 months.

- Analysis of 2026 ATC C governance problem– Privatization or Corporatization have challenged the aviation industry for more time than makes sense. It is almost intuitive to recognize that the ATC system delivers a critical service from one end of the National Airspace to another. It is a service that is provided 24/7/365 without regard to the Congress’ erratic funding history. Business decisions, like whether a ARTCC should be located in Congression District #1or #2/ State A or B, should be made on strict parameters—SAFETY, safety & safety, plus efficiency of the facility’s operation. The ATC must be managed by competent executives with the internal personnel recognize that (i) it is a good decision and (ii) the executive will be in office for a long time (bureaucratic delay will not avoid the decision). These and a number of relevant considerations strongly recommend that the future ATC be housed in a non-profit or federal corporation.

-

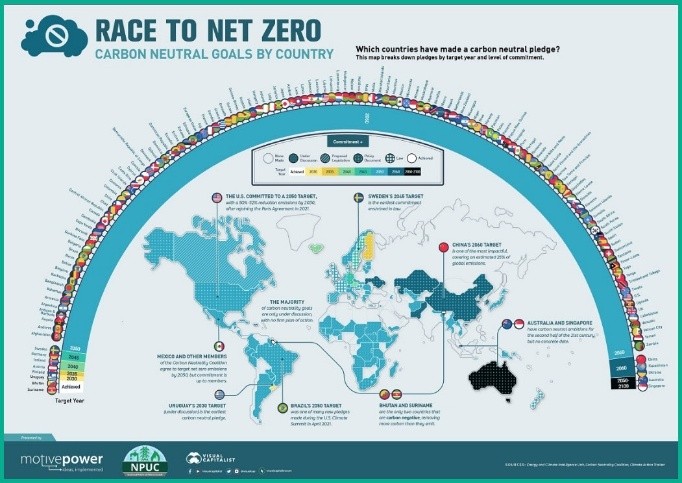

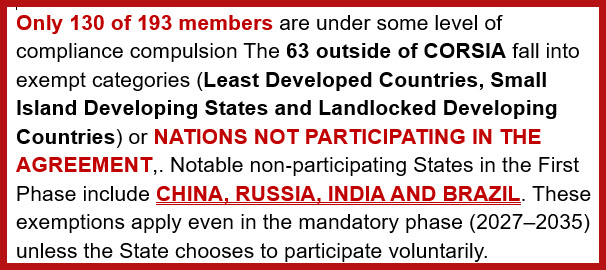

II. 2025 BREAKDOWN—CORSIA, SAF, 2025 Net Zero CO Emissions – Considerable effort and time was spent by the ICAO staff and hundreds of experts from industry, academia and NGOs plus the Member Nations’ professionals to come to an international agreement labeled Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

The agreement has entered its first formal implementation phase, which requires airlines [of nations participating in this environmental agreement] offset emissions above 85% of 2019 levels during Phase I (2024–2026). While some governments view it as a global minimum standard, the airlines so far (2024 estimate) have not yet reached this goal; THUS, demanding that the airlines of some countries must provide heavy offsets for the 2025–2028 compliance cycles[2]. ICAO has warned that demand for carbon credits will outpace SAF availability, pushing airlines toward offsets rather than fuel substitution. The Airlines under the CORSIA regimen are concerned that the market for CORSIA‑eligible credits is underdeveloped, with only a small number of approved credit types (e.g., ART‑verified REDD+ from Guyana).SAF CURRENTLY IS SOLD AT $600–$800 PER TON OF CO₂ EQUIVALENT. CORSIA‑ELIGIBLE CARBON CREDITS ARE AVAILABLE AT $5.70–$17.20 PER TON. This is why airlines describe the market as narrow and underdeveloped.

Airlines see CORSIA as cost‑exposed and dependent on credit markets–ICAO warns that demand for carbon credits will outpace SAF availability, pushing airlines toward offsets rather than fuel substitution. Airlines are concerned that the market for CORSIA‑eligible credits is underdeveloped, with only a small number of approved credit types (e.g., ART‑verified REDD+ from Guyana). SAF and Offsets increase the cost of airline flights. Query whether there are equally environmentally effective and more economical options.

CONTRAIL MITIGATION is widely recognized in aviation policy circles as a high‑impact, near‑term climate lever. Contrails matter–Contrails can contribute as much or more warming than CO₂ in the short term.. Mitigation strategies include sight altitude adjustments; avoiding ice‑supersaturated regions and engine/SAF blends that reduce soot (fewer ice nuclei). Airlines increasingly see contrail mitigation as cost‑effective compared to SAF. Governments view it as a complementary strategy that can deliver measurable climate benefits before SAF reaches a viable, affordable solution.

è PREDICTION FOR CORSIA, SAF, 2025 Net Zero CO Emissions ICAO may be compelled to reopen Pandora’s Box and reconvene the interested parties to consider (i) adopting CONTRAIL reduction as CORSIA’s primary tactic OR (ii) consider including credit for contrail mitigation, in its overall Carbon Emissions strategy OR (iii) whether non‑CO₂ effects should be incorporated into future phases.

Recent commentary on this issue:

- ICAO #42 report says CONTRAIL policies may avoid >90% of aviation-induced warming by 2050 From EPA Acid Rain lesson time to review CORSIA

- News about a new “breakthrough” in SAF poses the question of how these worthwhile efforts are being coordinated

- 3 major CONTRAIL CO2 reduction studies are progressing; must gather info for regulatory approvals

- IATA’s STUDY of Contrails is MOST INSTRUCTIVE

- SAF may be the solution to CONTRAILS

- Scourge of CONTRAILs being attacked by EASA and FAA

- Can Civil Aviation decrease CONTRAILS now???

IV- 2026 Breakdown– Aircraft Supply Chain Bottlenecks analysis– Persistent shortages of new aircraft and spare parts continue to constrain fleet growth and reliability. Boeing’s acquisition of Spirit’s Boeing-facing operations, while Airbus carved out key programmes, highlighted how dependent tier-one suppliers had become on a narrow customer base. More importantly, it raised uncomfortable questions about whether the current risk-sharing model between OEMs and suppliers is financially and operationally sustainable. How, in particular, Boeing manages the Spirit Aerospace organization [which was rife in the B-737 Max Problems] may point to acquisition of suppliers as a good or poor strategy.!!!

V Aircraft Supply Chain Bottlenecks prediction – this disruption may help PRC’s COMAIR 919 be bought by airlines without either FAA, EASA, UK CAA, Japan Civil Aviation Bureau (JCAB) or Brazil’s ANACV. 2026 BREAKTHROUGH –AAM advances in TC process (US and PRC) introduction ANALYSIS—The promise of these Aerial Taxis create visions of financial gains in the minds of all visionary entrepreneurs. Exponential growth charts exceed the commerce growth which FedEx and other air express airlines generated. Unfortunately, there are analysts[3] that cast aspersions on the AAM take-off projections. These viewpoints are summarized here:

Piloted AAM will have limited commercial viability because pilot labor is the single largest operating cost.

-

-

- They state that AAM only becomes broadly profitable “at scale and under a remote‑piloted scenario.”

- Early piloted operations will be narrow‑market, focused on premium routes (airport shuttles, tourism, major events).

- They emphasize that demand is highly price‑sensitive, and pilot‑driven costs push fares too high for mass adoption.

-

Interpretation:

Piloted AAM is a niche market; autonomy is required for real scale.

-

-

- Operating costs are far higher than OEMs claim, especially when pilot labor is included.

- The “City Taxi” and “Airport Shuttle” use cases are not economically viable at expected price points with a pilot onboard.

- They conclude that only autonomous or remotely‑piloted operations can unlock the mass‑market economics that OEMs advertise.

-

The Trump Administration is more bullish-Trump administration unveils 10-year strategy to advance US air taxi sector. The FAA’s forecast predicts–AAM will begin with piloted aircraft, but “operations are expected to begin in the near future” with highly automated aircraft, implying that autonomy is the intended economic model.

-

-

- AAM advances in TC process (US and PRC) introduction PREDICTIONS-

- AAM will be only for a niche marketplace– markets like UAE and Singapore where the drastic road congestion plus disposable income are more likely to balance costs of flights and elasticity of demand. LA Olympics and other extraordinary events will utilize the AAM aircraft.

- Manufacturers put focus on electric power supply. Hybrid electric is more likely to achieve the needed range to attract customers. 2nd wave

- PRECAUTION—A MANNED OR UNMANNED ACCIDENT will impact passenger interest in the aerial taxis, even if the aircraft was certificated by the PRC.

-

VI-2026 prognosis- Cyber Security threats increase– the basis for this prediction is general apprehensions with no information allowed to be cited.

VII_ 2026 BREAKDOWN The MH370 aircraft wreckage will be found in 2026 and the investigators will findings the CVR and FR. Given the political sensitivity they will likely find but may or may not reveal significant issues that will drive new ways to screen pilots for mental issues.

- PREDICTION-Given the international labor implications, ICAO, not individual States, will have to lead an appropriate task force to establish global criteria for identification of risks as well as acceptable intervention protocol.

VIII- 2025 BREAK THOUGH–AI begins to transform commercial aviation operations–Artificial intelligence moved from concept to practical deployment in 2025, emerging as one of the year’s most talked-about technological trends in aviation. Airlines, airports and manufacturers alike are increasingly using AI to streamline operations, enhance safety and improve passenger services.AI-driven predictive maintenance tools are now analyzing vast amounts of sensor and flight data to flag potential aircraft faults before they lead to costly delays or groundings. AI is being used in airports to speed turnarounds and improve the immigration process.

- PREDICTION- CAUTION will define the pace of AI implementation. The potential is great but the full scope of consequences are unknown. A few recent posts add to the AI risks and benefits-

- AI comments on EASA’s 2nd issue paper on Artificial Intelligence

- Standdown points to AI as THE TOOL to create a new SAFETY INTELLIGENCE- how to get there???

- AI’s Corpus Linguistics can clean up the MX records MESS, yes?

- The promise of AI’s power and application of Aviation’s 10⁻⁹ safety risk standard

The turbulence of 2025 hopefully will not continue next year. That confidence is based on the commitment of the millions of dedicated aviation professionals.

HAPPY NEW YEAR’S

[1] Every DOT press release involving Mr. Duffy always includes a reminder that he’s a #47 appointee?

[2] Airlines must-Monitor, report, and verify (MRV) their CO₂ emissions annually (mandatory for all operators above 10,000 tonnes CO₂). Receive notice of offsetting requirements from their State by November of the following year (e.g., 2024 emissions → notice by Nov 2025). Surrender eligible emission units (carbon credits) by the end of the compliance window (up to 2028 for Phase I).Eligible Credits-For Phase I, ICAO has approved–ART (Architecture for REDD+ Transactions) , ACR (American Carbon Registry)with additional registries conditionally approved. This is why airlines describe the market as narrow and underdeveloped.

[3] L.E.K. Consulting — Mark Streeting & George Woods; Advanced Air Mobility — Cost Economics and Potential. Roland Berger + German Aerospace Center (DLR), Unit Economics for AAM