IATA’s two urgent warnings may merit reconsideration of the chosen path to 2050

This is a repeat title and it is brought up again [1]because of two contemporaneous press releases–one warns that there is a capacity crisis and the second flags SAF mandates as impeding the green goals. Multiple recent developments have highlighted that there may be other equally efficacious options to achieve the 2050 Net Zero Carbon Emissions Goal.

There is no question that Carbon Emission reduction is critical to Planet Earth’s future, but the two IATA statements suggest that the current formula to reach this goal merit reconsideration. HOW and WHEN need reexamination at the highest levels, not WHY.

The confluence of these two IATA reports points to an anomalous result of capacity and SAF problems—THE PRC IS LARGEST CONTRIBUTOR TO GLOBAL CARBON EMISSIONS, accounting for approximately 34% of the world’s total CO₂ output. Yet it does not participate on CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation),ICAO’s global market-based measure to address CO₂ emissions from international aviation.

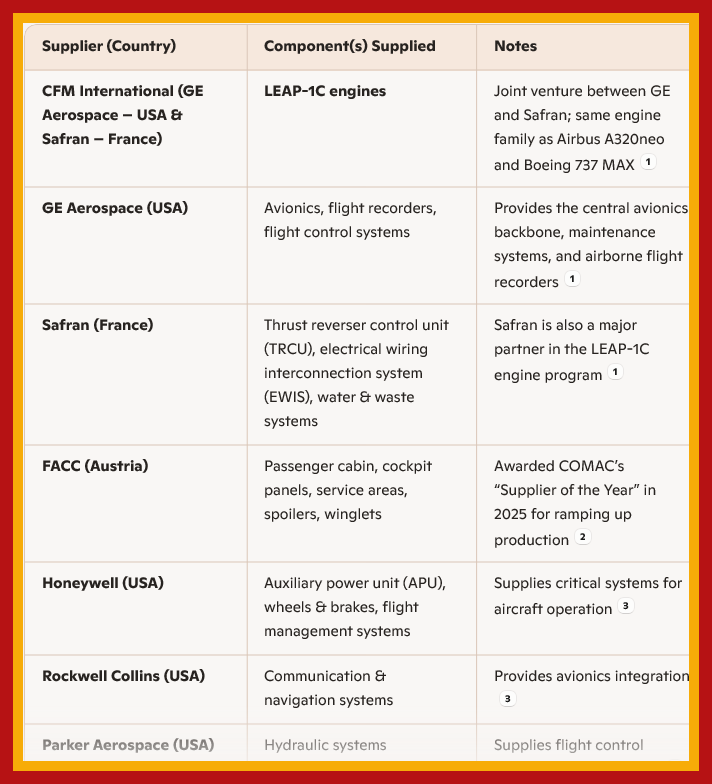

The COUNTRY (not a company; COMAC is part of the Peoples Republic of China) may be the beneficiary of the IATA concern that the future inventory of commercial aircraft is inadequate. COMAC has cobbled together its COMAC C919, heavily relying on nations in compliance with CORCIA–

A global aviation policy that rewards the country with a horrendous environmental policy is the ANTITHESIS of good results. ICAO should call its members to Montreal to consider the green advances in aviation—

- Sustainable Aviation Fuel (SAF)

- Hydrogen-Powered Aircraft

- Electric & Hybrid-Electric Propulsion

- Lightweight Materials

- Next-Generation Engines

- Air Traffic Management (ATM) Modernization

- Direct Air Capture (DAC) + Synthetic Fuels

- Hybrid Hydrogen-Electric Concepts

- Urban Air Mobility (UAM)

Calculating the right path to true Carbon Emissions is not a linear exercise but a multivariate algorithm. All of the innovation listed above have collateral consequences (i.e. SAF agricultural stock impact?). The urge to define quickly a pathway that will placate the populace generalized anxieties may have selected a “solution” that is not now the BETTER OPTION.

IATA warns aircraft demand is set to outpace production capacity

pio3 / Shutterstock.com

Global aircraft and engine production is heading toward a RENEWED CAPACITY CRUNCH, the International Air Transport Association (IATA) warned on December 9, 2025, as delivery shortfalls surpassed 5,300 aircraft and the global order backlog climbed beyond 17,000 planes, equivalent to nearly 12 years of output at current production rates.

Meanwhile, the average fleet age has risen to 15.1 years, and more than 5,000 aircraft remain in storage, highlighting the persistent gap between demand and available aircraft despite the critical shortage of new ones.

IATA expects limited aircraft availability to cost the airline industry over $11 BILLION IN 2025, despite increasing aircraft deliveries.

“Higher leasing costs, reduced scheduling flexibility, delayed sustainability gains, and increased reliance on suboptimal aircraft types are the most obvious challenges,” said Willie Walsh, IATA’s Director General. “No effort should be spared to accelerate solutions before the impact becomes even more acute.”

He added that travelers are already feeling the effects of these supply constraints, as they are facing higher costs due to the tighter demand/supply conditions.

IATA warns of new challenges in aviation

IATA disclosed that new challenges are emerging in the industry as a result of production bottlenecks. According to the agency, AIRFRAME PRODUCTION IS OUTPACING ENGINE PRODUCTION, the CERTIFICATION TIMELINES FOR NEW AIRCRAFT HAVE EXTENDED TO FOUR TO FIVE YEARS, and LABOR SHORTAGES ARE HINDERING MANUFACTURING.

Tariffs on metals and electronics stemming from US-China trade tensions have contributed to additional delays, IATA added.

The agency also warned that fuel efficiency improvements are slowing as the fleet ages. The agency said that the air cargo fleet’s situation may change, with fewer planes available for conversion, delays in new widebody aircraft, and older freighters nearing retirement.

According to IATA, the gap between airline demand and aircraft production is unlikely to fully recover before 2031–2034 due to “irreversible losses on deliveries over the past five years and a record-high order backlog”.

TO HELP ADDRESS THESE LONG-TERM SUPPLY CHALLENGES, THE ASSOCIATION RECOMMENDED

- enhancing MRO INDEPENDENCE from OEMs,

- increasing SUPPLY CHAIN VISIBILITY,

- utilizing DATA FOR PREDICTIVE MAINTENANCE,

and

- EXPANDING REPAIR AND PARTS CAPACITY.

SAF Production Growth Rate is Slowing Down, Essential to Correct Course Ahead of e-SAF Mandates

Geneva – The International Air Transport Association (IATA) released new estimates for Sustainable Aviation Fuel (SAF) production showing that:

- In 2025, SAF output is expected to reach 1.9 million tonnes (Mt) (2.4 billion liters), double the 1 Mt produced in 2024. However, in 2026, SAF production growth is projected to slow down and reach 2.4 Mt.

- SAF production in 2025 represents only 0.6% of total jet fuel consumption, increasing to 0.8% the following year. At current price levels, the SAF PREMIUM translates into an ADDITIONAL USD 3.6 BILLION in fuel costs for the industry in 2025.

- The estimated SAF output for 2025 of 1.9 Mt is a downward revision from IATA’s earlier forecasts due to lack of policy support to take full advantage of the installed SAF capacities. SAF PRICES EXCEED FOSSIL-BASED JET FUEL BY A FACTOR OF TWO, AND BY UP TO A FACTOR OF FIVE IN MANDATED MARKETS.

“SAF production growth fell short of expectations as poorly designed mandates stalled momentum in the fledgling SAF industry. If the goal of SAF mandates was to slow progress and increase prices, policymakers knocked it out of the park. But if the objective is to increase SAF production to further the decarbonization of aviation, then they need to learn from failure and work with the airline industry to design incentives that will work,” said WILLIE WALSH, IATA’s Director General.

“SAF production growth fell short of expectations as poorly designed mandates stalled momentum in the fledgling SAF industry. If the goal of SAF mandates was to slow progress and increase prices, policymakers knocked it out of the park. But if the objective is to increase SAF production to further the decarbonization of aviation, then they need to learn from failure and work with the airline industry to design incentives that will work,” said WILLIE WALSH, IATA’s Director General.

The Negative Effects of EU & UK SAF Mandates

Mandates in the EU and UK have failed to accelerate SAF production and adoption:

- In Europe, ReFuelEU Aviation has sharply increased costs amid limited SAF capacity and oligopolistic supply chains. Fuel suppliers have widened their profit margins to such an extent that airlines pay up to five times more than the price of conventional jet fuel and double the market price of SAF. All this comes without guaranteeing supply or consistent documentation.

- The UK’s SAF mandate has triggered price spikes, leaving airlines to absorb the burden.

The cumulative impact of POORLY DESIGNED POLICY FRAMEWORKS is that airlines paid a premium of USD 2.9 billion for the limited 1.9 Mt of SAF available in 2025. Of this, USD 1.4 billion reflects the standard SAF price premium over conventional fuel.

“Europe’s fragmented policies distort markets, slow investment, and undermine efforts to scale SAF production. Europe’s regulators must recognize that its approach is not working and urgently correct course. The recent European Commission STIP announcement is a step forward though it lacks a clear timeline. Actions, not words, are what matter,” said Walsh.

The failure to accelerate the expansion of SAF production capacity will cause many airlines to review their own SAF targets. “Regrettably, many airlines that have committed to use 10% SAF by 2030 will be forced to reevaluate these commitments. SAF is not being produced in sufficient amounts to enable these airlines to achieve their ambition. These commitments were made in good faith but simply cannot be delivered,” said Walsh.

Looking Ahead to e-SAF Mandates

With e-SAF mandates approaching in the UK (2028) and EU (2030), it’s essential not to repeat the policy missteps seen with SAF.

Already, e-SAF faces a much higher cost base, potentially up to 12 times that of conventional jet fuel. Without strong production incentives (as opposed to mandates), supply will fall short of targets. On top of that, compliance costs could escalate to EUR 29 billion by 2032 if targets aren’t met, as seems very likely with the current policy framework.

“Given the low SAF production volumes, it is evident that current policies are not having the desired effect. Faced with such facts, regulators must course-correct, ensure the long-term viability of SAF production, and achieve scale so that costs can come down. MANDATES HAVE DONE JUST THE OPPOSITE, AND IT IS OUTRAGEOUS TO REPEAT THE SAME MISTAKES WITH E-SAF MANDATES,” said Marie Owens Thomsen, IATA’s Senior Vice President for Sustainability and Chief Economist.

[1] https://jdasolutions.aero/blog/is-saf-the-answer-to-net-xero-carbon-emissions-2050-goal/; https://jdasolutions.aero/blog/news-about-new-breakthrough-in-saf-poses-the-question-of-how-these-worthwhile-efforts-are-being-coordinated/