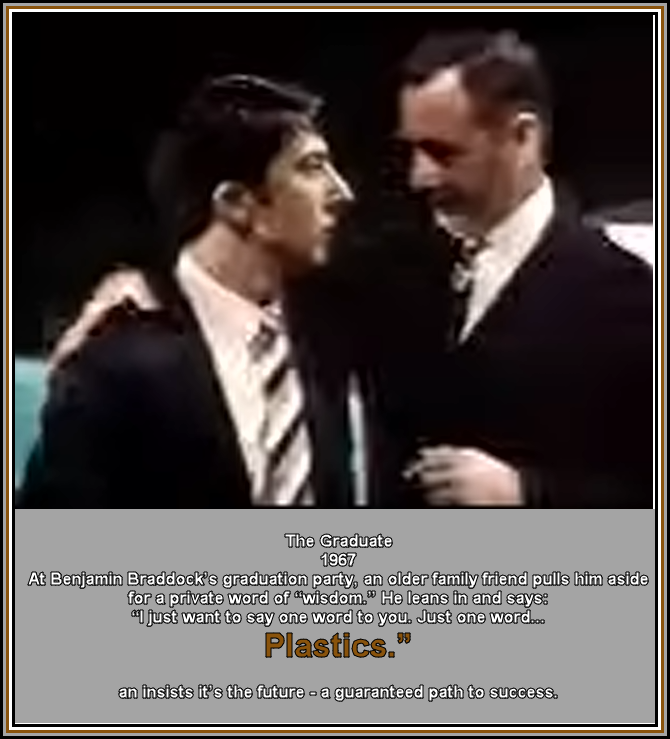

The Graduate’s advice in 2026 context- BATTERIES- so many technologies- FAA path?

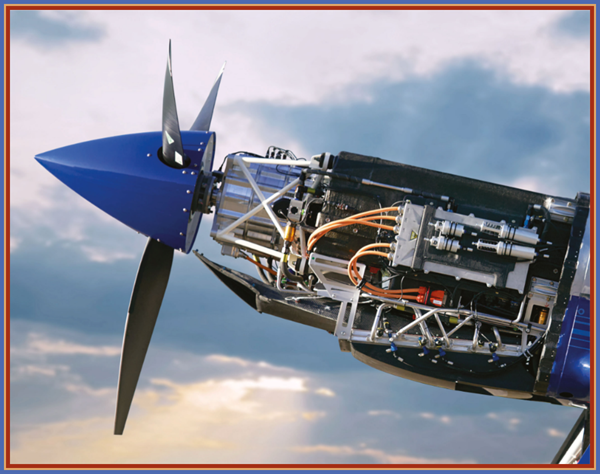

The next generation of aircraft from drones to AAMs/eVTOL to regional short haul aircraft and eventually long range airliners DEPENDS on advances in NON-FOSSIL FUELS. MITECHNEWS.com has published a useful inventory of America’s automative manufacturing state’s battery talents and leaders.

The attached article caused a flashback to the 1967 movie, “THE GRADUATE” in which an adult mentor pointed the recent graduate (Dustin Hoffman) that his career should be directed to PLASTICS. The parallel advice today would be batteries. As the Michigan article recognizes, automotive applications will require large supplies, thus MASS MANUFACTURING (e.g. PRC) will the primary source. The same author makes the point that aviation demands more—

- Weight savings,

- thermal stability,

- redundancy,

- certification

- AND

- MUST PERFORM UNDER EXTREME CONDITIONS, EVERY TIME, WITH NO MARGIN FOR ERROR.”

So, what are the metes and bounds of this effort to find the alternative to carbon fuels?

As the report below makes clear, aviation energy systems specifications require these elements:

- Gravimetric energy density (Wh/kg or MJ/kg)

- Volumetric energy density (Wh/L)

- Thermal management & safety

- Scalability & manufacturability

- Certification readiness

- Infrastructure requirements

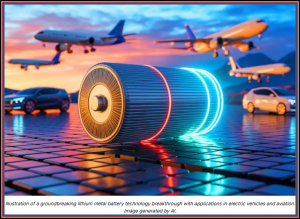

Preliminary research [eVTOL Batteries Hit a Tipping Point: What You Need to Know for 2026 and Beyond, Shock in Aerospace as China Reveals High-Energy Battery Capable of Powering Electric Aircraft and Disrupting Jet Age Forever; China firm sets 2027 target for electric plane with 1,800 mile range ]indicates that lithium‑ion, hydrogen, and next‑generation chemistries such as lithium–sulfur and sodium‑air fuel cells likely provide the best options for the next generation of energy sources. Here are some of those insights

- Lithium‑Ion (Li‑ion)

- Mature and widely used in eVTOL prototypes, commuter aircraft, and hybrid demonstrators.

- Energy density approaching physical limits (~300 Wh/kg).

- Suitable for short-range (≤200 nm) missions.

- Industry Leaders—Amprius, Panasonic, CATL, LG Energy Solution, aero, Beta Technologies, Joby Aviation –

- Academic Leaders—Stanford, MIT ,University of Michigan

∙Lithium–Sulfur (Li‑S) & Solid‑State Batteries

- Li‑S offers 400–600 Wh/kg potential.

- Solid‑state batteries promise higher safety and energy density but remain early-stage.

- Industry Leaders–OXIS Energy, Sion Power, QuantumScape –

- Academic Leaders–Concordia University, University of Texas at Austin ,Argonne National Laboratory

∙ Hydrogen (Liquid Hydrogen & Fuel Cells)

- Hydrogen has 3× the power density of kerosene by mass.

- Requires cryogenic tanks, new aircraft architectures, and airport infrastructure.

- Large hydrogen aircraft possible from ~2035 onward.

- Industry Leaders—Airbus, ZeroAvia ,H2FLY,Rolls‑Royce –

- Academic Leaders–TU Delft, Cranfield University, MIT

∙ Sodium‑Air Fuel Cells (MIT Breakthrough)

- Lab-scale prototype with >3× Li‑ion energy density demonstrated.

- Uses liquid sodium metal + air cathode + ceramic electrolyte.

- Could meet the 1,000 Wh/kg threshold for practical electric aviation

Ventures not relying on new batteries include- SAF and a long list of emerging technologies.

New technologies, almost by definition, are found by those who have approached the problem from a non-traditional perspective. These researchers know their science and engineering well, but may not be familiar with the regulatory requirements. Aviation safety certification criteria are not intuitive and even if discernible by an outsider, the FAA’s request for determining airworthiness[1] are subject to dialogues, sometimes difficult, between the FAA staff and the applicant.

Having insight –about what the regulators want and have mandated in the past—is essential to moving the certification process at above glacier speed.

Aircraft Batteries Emerge As A Strategic Niche—And Michigan Knows How To Play It

ANN ARBOR – As transportation electrification accelerates, batteries have become the central technology reshaping everything from electric vehicles rolling off Michigan assembly lines to experimental aircraft preparing for first flight. While the automotive electric vehicle battery market continues to explode in size, a quieter — but strategically important — opportunity is emerging in aircraft batteries.

Global demand for aircraft batteries is projected to nearly double over the next decade, growing from roughly $1.4 billion today to nearly $3 BILLION by 2034 as aviation adopts more-electric architectures, hybrid propulsion systems, and electric vertical takeoff and landing (eVTOL) aircraft. That growth is modest compared with the automotive EV battery market, which analysts expect to exceed $600 billion globally in the same timeframe.

But industry experts say size alone misses the point.

“Aircraft batteries are not a volume business like EV batteries,” said Mark Ellis, an aerospace electrification analyst based in the Midwest. “They’re a precision business. And that plays directly to Michigan’s strengths.”

Two Battery Markets, Two Very Different Rules

Automotive batteries are driven by scale, cost reduction, and speed. Gigafactories, federal incentives, and global competition dominate the landscape as automakers race to electrify fleets and bring down per-kilowatt-hour costs.

Aircraft batteries operate under an entirely different set of constraints.

In aviation, batteries power engine starts, auxiliary systems, emergency backup, and increasingly hybrid-electric propulsion. Weight savings, thermal stability, redundancy, and certification are paramount — often at the expense of cost or volume.

“Aviation batteries don’t get to fail gracefully,” said Dr. Lena Hoffman, a battery materials researcher who works with aerospace suppliers. “THEY MUST PERFORM UNDER EXTREME CONDITIONS, EVERY TIME, WITH NO MARGIN FOR ERROR.”

This difference explains why automotive battery production can scale rapidly, while aircraft battery adoption moves deliberately — governed by safety validation and regulatory timelines.

Where Michigan Fits[2] — Especially for Aerospace Suppliers and Startups

Michigan’s role in battery innovation goes far beyond EV assembly lines. For aerospace suppliers and mobility startups, the state’s advantage lies in systems engineering, safety culture, and certification-ready design.

Rather than competing to manufacture commodity battery cells, Michigan companies are well positioned to supply the high-value layers aviation depends on:

- BATTERY MANAGEMENT SYSTEMS (BMS) WITH AVIATION-GRADE REDUNDANCY

- THERMAL MANAGEMENT AND FIRE-CONTAINMENT TECHNOLOGIES

- LIGHTWEIGHT ENCLOSURES AND STRUCTURAL INTEGRATION

- POWER ELECTRONICS AND ENERGY DISTRIBUTION

- TESTING, VALIDATION, AND CERTIFICATION SERVICES

“Michigan doesn’t need to outproduce Asia in battery cells,” Ellis said. “It needs to solve the hardest integration and safety problems. That’s where the real value is in aerospace. ”eVTOLs and Hybrid Aircraft: A Near-Term Opening

Fully electric commercial jets remain years away, but eVTOL aircraft and hybrid platforms are advancing much faster — creating an entry point for startups and Tier-2 suppliers.

These programs favor:

Smaller production runs

- Faster design iteration

- Openness to nontraditional suppliers

- Heavy reliance on batteries, software, and controls

Michigan mobility startups, many with roots in automotive electrification, are well suited to this phase of aviation’s transition.

“The same engineers who design battery packs for vehicles understand power management, safety-by-design, and systems integration,” Hoffman said. “Those skills translate surprisingly well to aviation.”

Automotive Scale as a Proving Ground, Aviation as the Prize

A common pathway is emerging across advanced mobility:

- Technologies are developed in research labs

- Proven in automotive or off-road vehicle deployments

- Adapted and certified for aviation programs

Michigan uniquely supports this progression, using automotive scale to validate durability and performance before moving into aerospace, where margins are higher and supplier relationships are far stickier.

Once qualified, aviation battery suppliers often remain embedded for decades, not model years.

“Aerospace doesn’t switch suppliers lightly,” Ellis said. “That makes it a long game — but a defensible one.”

Big Picture: Niche vs. Mass Market

| Market | Aircraft Batteries | Automotive EV Batteries |

| Current Market Size | ~$1.4B | ~$66B+ |

| 10-Year Outlook | ~$3B | ~$600B+ |

| Growth Driver | Aviation electrification | EV adoption & regulation |

| Production Scale | Low volume, high spec | Massive global scale |

| Michigan Advantage | Systems & safety | Manufacturing scale |

Bottom Line for Michigan’s Mobility Economy

Aircraft batteries will never rival automotive batteries in size. But they don’t need to.

For Michigan’s aerospace suppliers and mobility startups, aircraft batteries represent a high-barrier, high-value extension of the state’s EV expertise — one where trust, engineering depth, and certification readiness matter more than sheer scale.

As electrification reshapes transportation on land and in the air, Michigan’s opportunity is clear: build the systems others rely on — and the batteries that must never fail.

[1] Lithium Battery Systems for Aerospace Applications; RTCA DO‑311A (rechargeable Li‑ion);RTCA DO‑227 (primary lithium); FAA AC 20‑184 / 20‑184A (installation guidance); FAA AC 21‑84 (certification checklist)

[2] (i)Major University Battery R&D Hubs: (a)University of Michigan – Ann Arbor; U‑M Battery Lab 2.0 on Ellsworth Road; Electric Vehicle Center (EVC). (b) Michigan State University – East Lansing. (c)Michigan Technological University – Houghton(ii) Major Battery Manufacturing & Development Companies in Michigan- (a) LG Energy Solution Michigan – Holland. (b)Ford Motor Company – Blue Oval Battery Park Michigan (Marshall) (c) Henkel Battery Application Center – Michigan. (d)Korean Battery Ecosystem Presence–Michigan hosts Samsung SDI + Stellantis and LG Energy Solution facilities as part of the Korean battery supply chain footprint in the U.S..