FAA’s CARE checks were signed without proper checking.

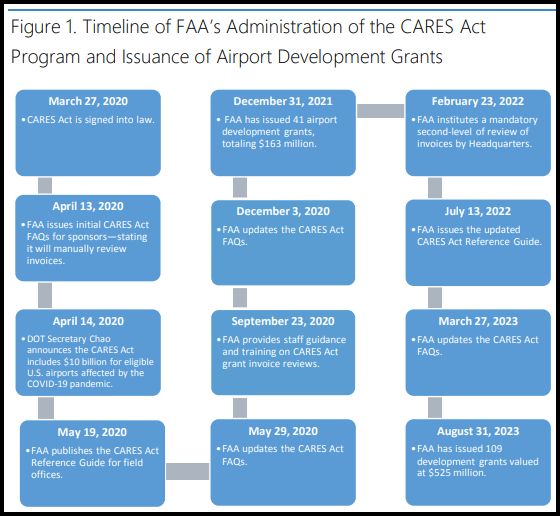

Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act relatively quickly and with unanimity from both parties despite its $2.2 trillion price tag, indicating the severity of the global pandemic and the need for emergency spending, as viewed by lawmakers. C.A.R.E.S. established specific criteria for payments to U.S. airports affected by the COVID-19 pandemic. Here are the key points related to airport funding:

Airport Improvement Program (AIP) Enhancement:

{apologies for the odd organization below–WORD PRESS has a mind of its own!!!}

- The CARES Act provided $10 billion in economic relief to eligible U.S. airports

- . For primary commercial service airports with over 10,000 annual passenger boardings, additional funds were allocated based on the number of annual boardings, similar to how they currently receive AIP entitlement funds.

- The act temporarily increased the federal share to 100 percent for AIP and supplemental discretionary grants already planned for fiscal year 2020. Normally, AIP grant recipients contribute a matching percentage of project costs, but this requirement was waived to ensure critical safety and capacity projects could proceed regardless of airport sponsors’ financial situations.

- National Airport System Funding:

- All commercial service airports (including reliever airports and some public-owned general aviation airports) received funds based on:

- The number of passengers boarding aircraft.

- The airport’s debt level.

- The airport’s reserve funds.

- All commercial service airports (including reliever airports and some public-owned general aviation airports) received funds based on:

- Application Process:

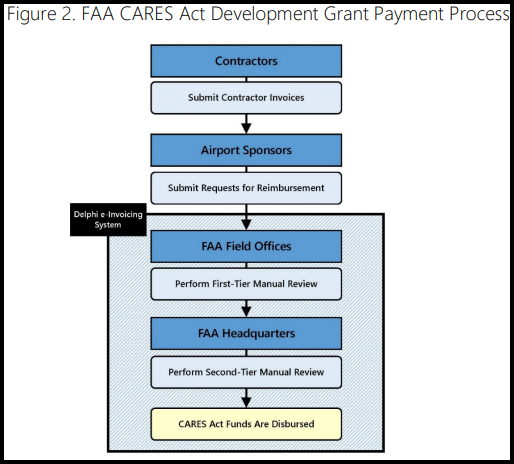

- Airport sponsors seeking reimbursement for development costs worked with their local Office of Airports field office to apply for a CARES Act Airport Development Addendum to their initial CARES Act Airport Grant.

- The Federal Aviation Administration (FAA) made these funds available in April.

This massive expenditure was justified as a critical response to the CORONAVIRUS. The above summary of the legislative policies and procedure to determine whether CARES $ could be awarded. The Administration set a high priority on issuing the checks and below are three reviews of the FAA’s performance under these criteria and with such prioritization.

- The US DOT Office of Inspector General (first report below) found that the FAA Airports organization “did not did not always follow its procedures…did not carefully review its processes…did not always require sponsors to submit reports…oversight gaps…not sure project costs were reasonable…”

- A summer 2023 report (second below) from the OIG identifying risks.

- These two reports point out the difficult prerequisites associated with these statutory parameters. The third document is a copy of the FAA’s guidance. The AMBIGUITIES and CRITICAL JUDGMENTS posed challenges incapable of quick resolution. A quick review of the reviews demonstrates the enormity of their tasks!!!

- The last story was written by Reason Foundation’s Bob Poole. This expert’s quantitative analysis raises some significant public policy issues!!!

For over four decades, the AIP dollars have been expended carefully by the FAA. Priorities in making these grants started with demonstrated needs for capacity; the decision to accept a proposal was based on critical analysis of the sponsors’ data. CARES did not contemplate such an assessment. AIP strictures included sponsor demonstration of EEOC, NEPA, Small Business and other prerequisites; CARE does not appear to have such provisions. As Mr. Poole points out, the FAA must remind that the sponsors that CARE’s loose rules are not permanent.

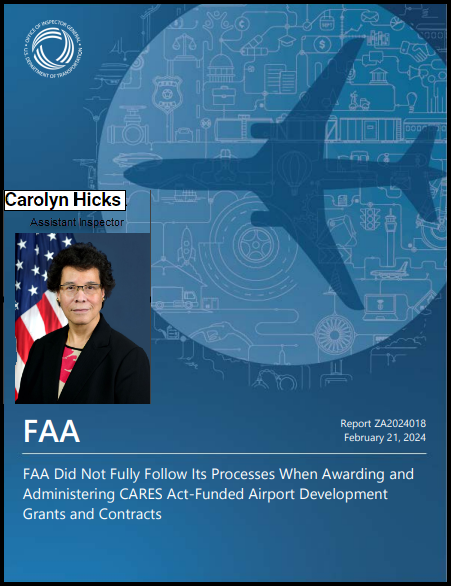

US DOT OIG Audit Report

Date FEBRUARY 21, 2024

ZA2024018

File Attachment

What We Looked At

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided the Federal Aviation Administration (FAA) with $10 billion in funding, including about $525 million for airport development expenses. FAA distributed these funds through its Airport Improvement Program (AIP), which requires grant recipients to comply with various Federal procurement requirements, including Buy American Preferences. Previous Office of Inspector General (OIG) audits identified weaknesses in FAA’s processes for awarding and administering AIP grants and its oversight of CARES Act funds. Given the size of the funding allocation, its expeditious distribution, and related findings in prior reports, we initiated this audit. Our objectives were to evaluate FAA’s processes for (1) awarding and administering CARES Act-funded airport development grants and (2) overseeing associated recipient contracts to ensure compliance with Federal and Agency grant and procurement requirements.

What We Found

FAA DID NOT ALWAYS FOLLOW its processes for awarding and administering its CARES Act airport development grants.

Specifically, FAA DID NOT CAREFULLY REVIEW development grant applications before it distributed CARES Act funds over 20 percent of the time and did not ALWAYS REQUIRE SPONSORS TO SUBMIT ANNUAL FINANCIAL REPORTS ON TIME. Although the Agency strengthened its oversight of CARES Act-funded invoices, it did not effectively communicate and adhere to these changes.

These OVERSIGHT GAPS PREVENT FAA FROM ASSURING THAT THE PROGRAM OPERATES AS INTENDED AND IN A FISCALLY RESPONSIBLE MANNER.

FAA’s CARES Act-funded airport development contracts also did not meet several key Federal requirements. The Agency did not ensure that sponsors met the requirements for completing cost or price analyses in MORE THAN 55 PERCENT OF CONTRACTS we reviewed. FAA also did not always ensure that Buy American waivers met all requirements prior to approval.

Thus, FAA CANNOT BE CERTAIN that project costs were reasonable or that sponsors complied with Made in America Laws. These issues result in A TOTAL OF $106 MILLION IN FUNDS AT RISK FOR BETTER USE.

Our Recommendations

We made eight recommendations to strengthen FAA’s oversight of CARES Act funds for airport development projects. FAA concurred with all eight recommendations and provided appropriate completion dates. We consider all recommendations resolved but open pending completion of the planned actions.

Submitting OIG:

Department of Transportation OIG

Report Description:

What We Looked At THE CORONAVIRUS AID, RELIEF, AND ECONOMIC SECURITY (CARES) Act provided the Federal Aviation Administration (FAA) with $10 BILLION to help airports deal with the public health emergency caused by Coronavirus 2019 (COVID-19). FAA AWARDED $9.1 BILLION IN GRANTS to airports nationwide, using its existing Airport Improvement Program (AIP) to distribute the funds. Our objective for this self-initiated audit was to assess WHETHER FAA’S POLICIES AND PROCEDURES for awarding and overseeing CARES Act grants are sufficient to PROTECT TAXPAYER INTERESTS.

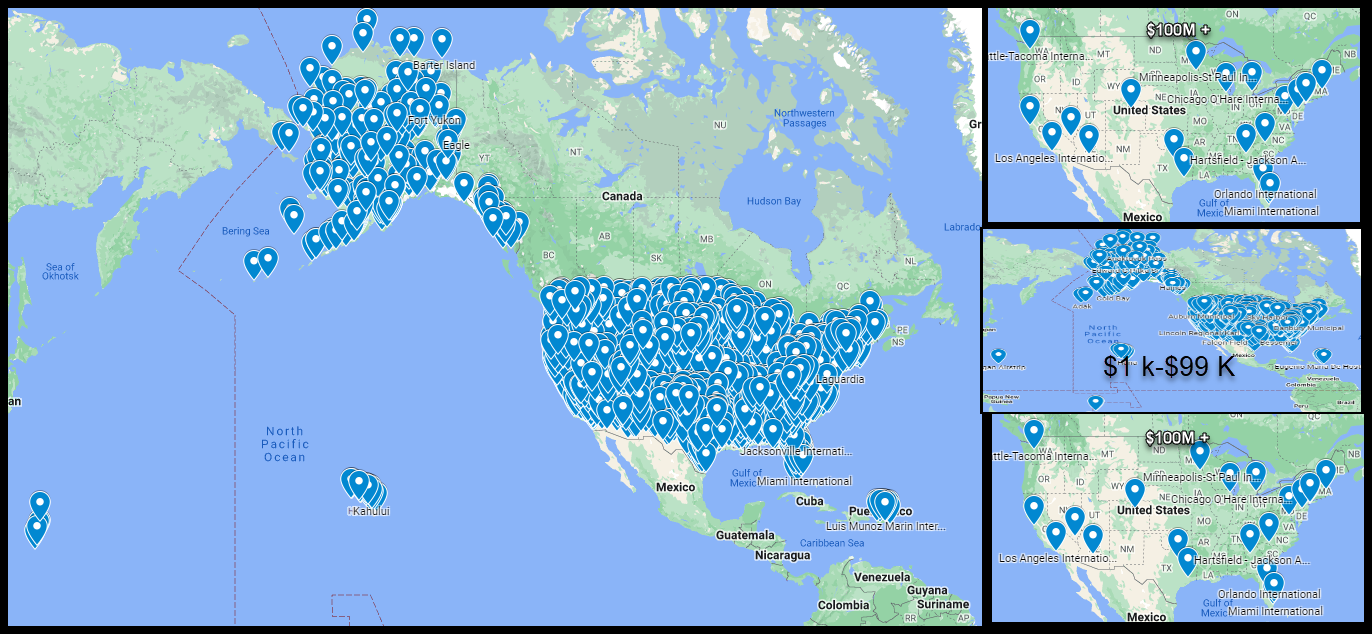

What We Found Leveraging the AIP allowed FAA to announce CARES Act awards for MORE THAN 3,000 AIRPORTS IN JUST 2 WEEKS. However, changes in the Agency’s oversight process regarding SUPPORTING DOCUMENTATION REQUIREMENTS affected its ability to monitor program performance, and we determined at the time of our review that it contributed TO MORE THAN $271 MILLION IN UNSUPPORTED COSTS, $85 MILLION IN QUESTIONED COSTS, AND $3 MILLION OF IMPROPER PAYMENTS.

FAA also did not establish procedures for DEOBLIGATING CARES Act grants that become inactive, exceed the period of performance, or provide airport sponsors with adequate guidance on documenting workforce retention data. These internal control weaknesses hindered FAA’s ability to ENSURE that it is OPERATING THE PROGRAM AS CONGRESS INTENDED, administering projects in a FISCALLY RESPONSIBLE MANNER, and ACHIEVING REPORTING AND COMPLIANCE OBJECTIVES.

Our Recommendations We are making seven recommendations to improve FAA’s oversight of COVID relief funds.

FAA concurred with recommendations 5–7 and provided completion dates. The Agency partially concurred with recommendations 1–4. Based on documentation FAA provided after our review was completed, we consider recommendation 1 resolved but open pending completion of planned actions, recommendations 2 and 3 resolved and closed, and recommendation 4 unresolved. We are asking FAA to reconsider its position and provide us with a revised response within 30 days of the date of this report.

Date Issued:

MONDAY, JULY 18, 2022

FAA Questions on Use of Funds

Q-U1: Can CARES Act Airport Grants funds be used to purchase an aviation or avigation easement?

A: YES, provided the purchase is consistent with 49 U.S.C. 47107(b) and (k)(2) (i.e., the expenditure is an airport operating cost that reflects the value received). Examples of expenditures that the FAA has found allowable are provided in the FAA Revenue Use Policy. The airport sponsor should consult with its local Airports District Office or Airports Regional Office because this purchase could be considered “airport development” and subject to additional requirements. See Q10

Q-U2: Can CARES Act Airport Grants funds be used to accelerate structured settlement agreements or pay the penalty for early defeasement of debt?

A: YES, provided the use of funds is consistent with 49 U.S.C. 47107(b) and (k)(2) (i.e., the expenditure is an airport operating cost that reflects the value received). Examples of expenditures that the FAA has found allowable are provided in the FAA Revenue Use Policy. If any part of the debt had been approved for Passenger Facility Charge (PFC) collections, the airport sponsor must amend its PFC approval in accordance with the requirements of 14 CFR § 158.37 to reflect the change. See Q-U20 through Q-U22 for more information on costs related to an approved PFC.

Q-U3: Can CARES Act Airport Grants funds be used for a surface access project (roads or rail/transit)?

A: Yes. This use is airport development, and therefore, additional requirements apply. See Q10.

Q-U4: Can CARES Act Airport Grants funds be used to prepay long-term contracts (for example, shuttle-bus operators, janitorial services, security services, fire and police services)?

A: Yes, provided the prepayment is a bona fide transaction where the sponsor receives the benefit of the prepaid services and receives some value in exchange for committing in advance.

Q-U5: Can CARES Act Airport Grants funds be deposited in the airport sponsor’s general reserve account (or invested for future use)?

A: No. The FAA would not be able to ensure a potential future use is a use consistent with the CARES Act requirements. Airports should submit invoices and underlying documentation for airport expenditures. See Q-I1 and Q-I2.

Q-U6: Can CARES Act Airport Grants funds be used to help bolster the local government’s pension fund?

A: Generally, no. However, if a portion of the fund has historically been supported by the airport and the support is proportional to the share paid to airport retirees, then the airport should consult with its local Airports District Office or Airports Regional Office to determine if such use is appropriate.

Q-U7: Can CARES Act Airport Grants funds be used to reimburse operational and maintenance expenses?

A: Yes. The FAA will reimburse sponsors for operational and maintenance expenses directly related to the airport incurred on or after January 20, 2020. Operational expenses are those expenses necessary to operate, maintain, and manage an airport. They include expenses such as payroll, utilities, service contracts, and items generally having a limited useful life, including personal protective equipment and cleaning supplies. Maintenance and repairs are limited to a project necessary to keep an asset in good working order but do not add material value or appreciably prolong the life of the asset.

Q-U8: Is there a limit on how much CARES Act Airport Grants funding may be used for operational and maintenance expenses?

A: No. An airport sponsor may use all of its CARES Act Airport Grants funds for allowable airport operational and maintenance expenses or debt service payments.

Q-U9: Can CARES Act Airport Grants funds be used to reimburse debt service payments?

A: Yes. The FAA will reimburse sponsors for debt service payments directly related to the airport that are due on or after March 27, 2020, which is the date of enactment of the CARES Act. This date applies for all CARES Act Airport Grants regardless of the date specified in those grant offers, and airport sponsors do not need to execute a grant amendment to invoice debt service payments due on or after March 27, 2020.

Q-U10: Can CARES Act Airport Grants funds be used to reimburse monthly payments into a debt service reserve fund?

A: Yes. The FAA will reimburse sponsors for monthly payments into a debt service reserve fund (also called a debt service sinking fund or similar name), which are directly related to the airport, that are due on or after March 27, 2020, which is the date of enactment of the CARES Act. The airport sponsor must ensure that these payments are restricted to only debt service payments. The airport sponsor will submit a detailed invoice summary with its payment request, as detailed in Question Q-I1 above. All documentation of the payment and disbursements must be retained for three years after the grant is closed, as required by 2 CFR § 200.334.

Q-U11: Can CARES Act Airport Grants funds be used to reimburse lost revenue?

A: No. CARES Act funds are available to reimburse operational expenses, debt service payments, and capital expenditures directly related to the airport. Lost revenue is not an eligible airport sponsor expense, and the airport sponsor does not need to identify any amount or type of lost revenue as part of its grant application, grant agreement, or invoice.

Q-U12: Can CARES Act Airport Grants funds be used to reimburse the local share on previously awarded AIP or Supplemental Discretionary grants?

A: Yes, with several limitations. CARES Act Airport Grants funds are available to reimburse eligible expenses, such as the local share of a previously awarded AIP or Supplemental Discretionary grant, provided the reimbursed expenses are directly related to the project approved under the grant and the expenses are incurred on or after March 27, 2020. An airport sponsor should contact its local Airports District Office or Airports Regional Office prior to submitting a request for payment for these expenses to ensure adequate underlying documentation.

Q-U13: Can CARES Act Airport Grants funds be used to match other Federal funds?

A: If a Federal program explicitly allows other Federal funds to be used as a match, and the project meets all requirements of the participating Federal agencies, then CARES Act Airport Grants funds may be eligible to match grants under such a program. Although CARES Act Airport Grants funds are available for any purpose for which airport revenues may be used, these funds are Federal financial assistance.

Q-U14: Can CARES Act Airport Grants funds be used to reimburse for a cost associated with an aeronautical service or product provided by the airport sponsor?

A: Yes, in certain circumstances. CARES Act Airport Grants funds are available to reimburse the costs associated with aeronautical products or services offered by the airport sponsor but only when the sponsor certifies it is the only provider of the same product or service at the airport. These services include aviation fuels, equipment, parts, supplies, and facilities for aircraft storage or maintenance. Costs associated with flight training or aviation training are not eligible for reimbursement.

Q-U15: Can CARES Act Airport Grants funds be used to reimburse depreciation?

A: No. Depreciation is not an allowable expense under a CARES Act Airport Grant. Although depreciation is an allowable operating expense by both the 2 CFR part 200 and the Revenue Use Policy, it does not impact cash flow because the cash or donation was considered at the acquisition of the asset, and the asset could have been financed by long-term debt, Federal grants, current funds, or donation.

Q-U16: Can CARES Act Airport Grants funds be used to reimburse charitable contributions or sponsorships?

A: No. Charitable contributions and sponsorships are not allowable expenses under a CARES Act Airport Grant. All reimbursements made under CARES Act Airport Grants must comply with 2 CFR part 200, “Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards.” Section 200.434, “Contributions and Donations” states that contributions and donations, including cash, property, and services, are unallowable.

Q-U17: Can CARES Act Airport Grants funds be used to reimburse economic development efforts?

A: Under the FAA Revenue Use Policy (see Q9), State, city, or county economic development efforts that do not exclusively benefit the airport are not eligible. Economic development efforts directly related to the airport can be reimbursed with CARES Act Airport Grants funds.

Q-U18: Can CARES Act Airport Grants funds be used to reimburse smaller invoices for items such as groceries for snack rooms or meals for airport personnel?

A: As long as the purchases are for lawful uses of airport revenue and comply with 2 CFR part 200, including the requirement to document the costs adequately, the March 27, 2023 16 items are eligible for reimbursement. However, IT CAN BE DIFFICULT TO DOCUMENT THAT THESE ITEMS ARE DIRECTLY RELATED TO AIRPORT USE. Larger invoices directly related to airport use are easier to review and approve.

Q-U19: Can CARES Act Airport Grants funds be used to purchase loading/boarding bridges?

A: Yes. Loading/Boarding bridges are considered part of a terminal building and eligible for reimbursement under a CARES Act Airport Grant. However, projects to purchase and install loading/boarding bridges require a Development Addendum.

Q-U20: Can CARES Act Airport Grants funds be used to reimburse debt service payments that are backed by an approved PFC and paid with PFC funds?

A: No. If PFC funds are available, the PFC funds must be used on any approved PFC project. CARES Act Airport Grants funds are not available to be deposited into PFC accounts. In accordance with 14 CFR § 158.39, public agencies cannot hold excess PFC funds in reserve for a future use. In addition, the requirements of 14 CFR part 158 apply to any new projects or changes in scope to existing projects.

Q-U21: Can CARES Act Airport Grants funds be used to reimburse debt service payments that are backed by an approved PFC?

A: Yes. The sponsor may supplement with other airport revenue and submit a request for payment under its CARES Act Airport Grant. The invoice summary should show the amount of debt service paid with PFC collections and the amount paid with non-PFC funds. The sponsor can submit a request for payment under its CARES Act Airport Grant at the same time it submits an amendment to an approved PFC, which decreases the total collection or deletes an approved project, to its local Airports District Office or Airports Regional Office.

Q-U22: Can CARES Act Airport Grants funds be used to reimburse the defeasement of debt backed by an approved PFC?

A: Yes. The airport sponsor can defease the debt with non-PFC funds and submit a request for payment under its CARES Act Airport Grant. HOWEVER, the airport sponsor must amend its PFC approval in accordance with the requirements of 14 CFR § 158.37 to reflect the change. A PFC amendment that decreases the total PFC revenue or deletes an approved project does not require airline consultation or a public comment period. An airport sponsor can submit a request for payment under its CARES Act Airport Grant at the same time it submits an amendment to an approved PFC to its local Airports District Office or Airports Regional Office

FAA Awards $1 Billion Discretionary Airport Grants: Why?

On Feb. 15, FAA proudly announced $1 billion worth of discretionary grants to airports large and small. Most were multiples of $1 million, and of the handful less than that sum, the smallest was $261,250 awarded to Bemidji Regional Airport in Minnesota.

After crunching the numbers of all 105 grants, I was surprised to learn that 64% OF THE TOTAL WENT TO AIRPORTS DESIGNATED BY FAA AS LARGE OR MEDIUM HUBS. The seven largest grants were to the following airports at this cost to taxpayers:

| Fort Lauderdale (FLL) | $50 million |

| Chicago O’Hare (ORD) | $40 million |

| Austin (AUS) | $39.5 million |

| Washington Dulles (IAD) | $35 million |

| Los Angeles International (LAX) | $31 million |

| San Francisco International (SFO) | $31 million |

Looking at these numbers, I have to ask, WHY IS SENDING FUNDS THAT ARE BORROWED FROM OUR GRANDCHILDREN TO LARGE AND MEDIUM HUB AIRPORTS A PRIORITY OF OUR FEDERAL GOVERNMENT? Of course, some will respond: ‘This is basic infrastructure, and we all know that infrastructure is important to a robust, productive economy.’

Fair enough, but large and medium hub airports are not exactly infant industries. Like the rest of commercial aviation, they have recovered from the brief but painful COVID-19 pandemic-related recession, so that is not a good reason for this new federal spending.

Moreover, large and medium hub airports ARE SELF-SUPPORTING BUSINESSES IN A GROWING INDUSTRY. They have access to the tax-exempt bond markets for revenue bonds and general obligation bonds. And since Congress two decades ago legalized passenger facility charges (PFCs), commercial airports have had an additional revenue stream which is also bondable and whose proceeds are mostly used to improve airport infrastructure.

A public-choice economist would assess the program as a bipartisan re-election effort, enabling many House and Senate members to announce the airport grants in a ‘See what I’ve done for you’ press release, regardless of whether or not they actually voted for the Infrastructure Investment & Jobs Act (IIJA) under which these grants were authorized.

My longer-term worry about grants like these is that—despite being the product of what’s billed as one-time ‘recover from the pandemic’ legislation—airport grant recipients may, in future years, view this federal funding as part of baseline funding expectations. The massive increases in federal funding under both the Trump and Biden administrations were almost entirely funded via borrowed money, which has INCREASED THE NATIONAL DEBT TO MORE THAN 100% OF THE GROSS DOMESTIC PRODUCT and which the Congressional Budget Office projects will lead to interest payments on said debt eating up increasing shares of the federal budget over the next decade. Such programs should not be repeated.