Bio-based Aircraft Coatings- big opportunity- need help through the FAA maze?

Future Market Insight, Inc. has published the below extensive and insightful article assessing the Bio-based Aircraft Coatings (BAC)opportunity over the next decade. Its conclusion is attractive for possible ventures in the aircraft coating segment as shown by this quote:

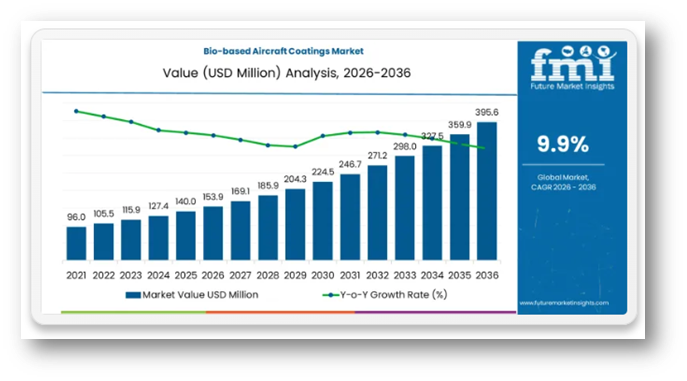

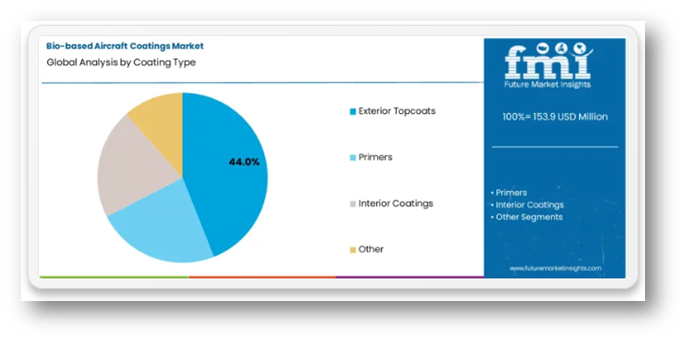

The bio-based aircraft coatings market is projected to grow from USD 153.9 million in 2026 to USD 395.6 million by 2036, at a CAGR of 9.9%. Bio-Based Solvents & Diluents will dominate with a 30.0% market share, while exterior topcoats will lead the coating type segment with a 44.0% share.

The report includes detailed estimates of the BAC segments with projected trends and CAGR for each line. The authors also frequently cite increasing environmental pressures/requirements as driving sales.

In each forecast, FMI mentions “REGULATORY REQUIREMENTS” but does not enumerate what steps are needed for permission to apply these innovative covertures for these environmental pluses. Before a new coating for aircraft may be used, the FAA imposes the following regulatory prerequisites:

If a manufacturer wants to introduce a bio‑based coating for aircraft use, they must demonstrate:

✔ Equivalent flammability performance

✔ Equivalent corrosion protection

✔ Equivalent durability (UV, erosion, chemicals)

✔ No adverse interaction with aircraft materials

✔ Compliance with all applicable FAA airworthiness standards

The FAA rules for certification involve many, many sections and subsections of 14 CFR Parts 21, 23, 25, 27& 29, AC 25.869-1A —Fire Protection: Systems, AC 25.869-1A, AC 43.13‑1B and ASTM standards. While safety advances are the FAA’s #1 priority, innovation poses a challenge to a request which involves new science. Which ones apply, where to submit an application, what must be submitted initially, how to manage the process, and a host of other questions can best be answered by Subject Matter Experts, who have been through this maze (CONTACT Mike Rioux, President, JDA Solutions)

Bio-based Aircraft Coatings Market Forecast and Outlook 2026 to 2036

The bio-based aircraft coatings market is valued at USD 153.9 million in 2026 and is projected to reach USD 395.6 million by 2036, reflecting a CAGR of 9.9%. Production is influenced by feedstock selection and formulation routes, including bio-based solvents, resins, binders, and additives. Coating type, aircraft class, and adoption stage affect material deployment and cost structures. Commercial aircraft dominate usage, followed by business jets and military platforms. Early adoption is concentrated in OEM sustainability programs, with MRO and aftermarket trials supporting incremental uptake. Margin concentration favors suppliers able to provide validated, certified coatings with repeatable performance, while smaller operators face integration and certification constraints.

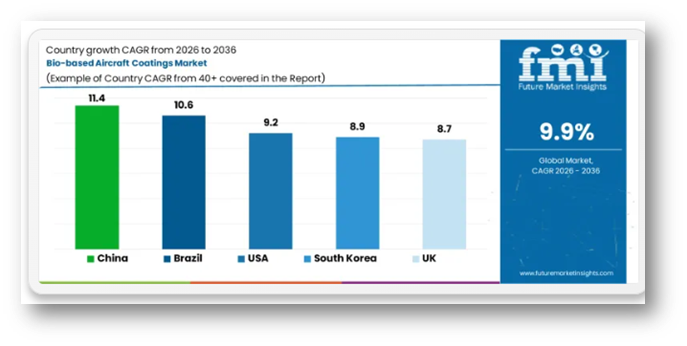

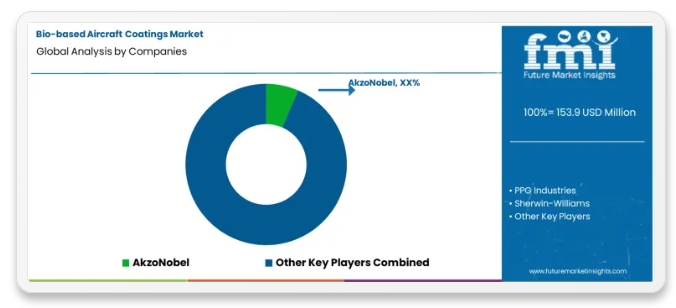

Performance depends on reliable supply of bio-based feedstocks and compatibility with existing application systems. ADOPTION VARIES REGIONALLY ACCORDING TO AIRLINE SUSTAINABILITY MANDATES, REGULATORY FRAMEWORKS, AND FLEET MODERNIZATION SCHEDULES. Operators with integrated production, multi-platform certification, and quality assurance achieve higher revenue concentration. Constraints include feedstock availability, process scalability, and certification timelines. Companies such as AkzoNobel, PPG Industries, Sherwin-Williams, BASF, Henkel, Mankiewicz, Arkema, Solvay, Dow, and Axalta capture value by aligning bio-based coatings with operational requirements and compliance verification…

What is the Growth Forecast for Bio-based Aircraft Coatings Market through 2036? ↑↑

…

Bio based Aircraft Coatings Market Key Takeaways

| Metric | Value |

| Market Value (2026) | USD 153.9 million |

| Forecast Value (2036) | USD 395.6 million |

| Forecast CAGR 2026 to 2036 | 9.90% |

How Is the Bio-Based Aircraft Coatings Market Evolving with Sustainable Aviation Trends?

Bio-based aircraft coatings are increasingly applied to reduce environmental impact while maintaining corrosion protection, durability, and aerodynamic performance. Historically, coatings relied on petroleum-derived resins and solvents, offering limited sustainability and regulatory alignment. Modern bio-based formulations use renewable raw materials, such as plant-derived polymers and resins, combined with advanced additives to meet performance standards. Airlines, maintenance providers, and aircraft manufacturers prioritize adhesion, chemical resistance, and regulatory compliance. Early adoption focused on experimental and retrofit programs, while current demand extends to commercial fleets responding to sustainability mandates, emission reduction goals, and eco-conscious branding. Coating compatibility, lifecycle performance, and application scalability influence supplier selection and deployment strategies.

Rising pressure to meet carbon reduction targets and regulatory sustainability requirements is shaping bio-based coatings adoption. Compared with conventional formulations, contemporary coatings emphasize high durability, UV stability, and process compatibility for large fleet operations. Cost structures depend on renewable feedstock sourcing, formulation complexity, and application labor, concentrating margins among suppliers delivering validated, high-performance bio-based coatings. Airlines adopt these coatings to reduce environmental footprint, maintain structural protection, and achieve compliance with green aviation standards. By 2036, bio-based aircraft coatings are expected to become a standard consideration in fleet maintenance and new-build programs, supporting both operational performance and sustainable aviation initiatives.

What Factors Are Shaping the Demand for Bio-Based Aircraft Coatings in Terms of Feedstock, Route, and Coating Type?

The demand for bio-based aircraft coatings is segmented by feedstock and route as well as coating type. Feedstock includes bio-based solvents and diluents, bio-based resins or binders, bio-based additives, and other renewable components. Coating types cover exterior topcoats, primers, interior coatings, and other specialized applications. Segment adoption is influenced by environmental regulations, operational safety, and performance requirements. Uptake is driven by sustainability objectives, reduction of volatile organic compounds, and regulatory compliance. Feedstock and coating selection depends on surface type, aircraft application, and performance targets, ensuring durability, safety, and compliance across commercial and military aircraft operations.

Why Are Bio-Based Solvents and Diluents Leading the Feedstock Segment in Aircraft Coatings?

Bio-based solvents and diluents account for approximately 30% of total feedstock demand, MAKING THEM THE LEADING CATEGORY. These materials replace conventional petrochemical solvents while maintaining coating performance for aircraft exterior and interior surfaces. Airlines and manufacturers adopt bio-based solvents to reduce environmental impact, comply with emission regulations, and support sustainable operations. Adoption is reinforced by compatibility with resins, binders, and additives in both topcoat and primer layers. Coatings maintain viscosity, drying time, and adhesion properties, ensuring consistent application and surface finish. The segment leads because bio-based solvents combine operational reliability with environmental compliance in modern aircraft coatings.

Operational considerations further support adoption. Solvents must perform across varying temperatures, humidity, and application techniques while maintaining safety standards. Maintenance teams verify uniform drying, surface smoothness, and chemical stability during scheduled inspections. Bio-based solvents reduce volatile emissions and support long-term environmental compliance without compromising coating performance. The segment leads because these materials provide sustainable alternatives that integrate seamlessly with aircraft coating processes while ensuring durability and operational efficiency.

Why Are Exterior Topcoats Representing the Largest Coating Type Segment in Bio-Based Aircraft Coatings?

Exterior topcoats account for approximately 44% of total coating type demand, making them the largest segment. These coatings protect fuselage, wings, and tail surfaces from environmental stressors such as UV radiation, rain, and airborne contaminants…

Operational factors influence adoption. Exterior topcoats must adhere to substrates, maintain aerodynamic smoothness, and resist weathering while preserving coating color and gloss. Application procedures include controlled thickness and curing for uniform coverage. Coatings reduce lifecycle maintenance costs and extend aircraft surface lifespan. The segment leads because exterior topcoats provide the most significant protection, operational efficiency, and measurable performance benefits in bio-based aircraft coating systems.

How Are Bio-based Coatings Shaping Sustainable Aviation?

Bio-based aircraft coatings are increasingly applied to commercial, military, and business aircraft to reduce environmental impact while maintaining protection against corrosion, UV exposure, and abrasion. Adoption is strongest in regions with strict environmental regulations and sustainability initiatives. Coatings are selected for adhesion, durability, and compatibility with existing maintenance procedures. Growth is driven by regulatory compliance, operational efficiency, and corporate sustainability targets. Investment focuses on material formulation, long-term performance, and integration with aircraft surfaces. Operators prefer coatings that reduce VOC emissions, extend service intervals, and maintain aerodynamic performance while supporting regional environmental and safety standards.

Why Are Environmental Regulations and Sustainability Targets Driving Adoption?

Airlines and OEMs adopt bio-based coatings to comply with regional environmental policies and reduce the use of petrochemical-based product…

What Factors Restrict Broader Implementation of Bio-based Coatings?

Higher formulation costs and limited availability of certified bio-based resins restrict adoption. Performance can be affected by temperature extremes, UV exposure, and chemical contact. Application requires trained personnel and controlled conditions to achieve uniform coverage. Regulatory approvals and certification timelines may delay deployment….

How Are Innovation and Industry Collaboration Influencing Bio-based Coating Adoption?

Advancements include improved resin chemistry, hybrid formulations, and coatings with enhanced durability and environmental performance. Collaboration between coating manufacturers, aircraft OEMs, and airlines enables real-world testing, performance validation, and regulatory alignment. Pilot programs assess adhesion, weather resistance, and maintenance requirements before large-scale application….

What is the Demand for Bio-Based Aircraft Coatings by Country?

…

How Is the United States Experiencing Growth in the Bio-based Aircraft Coatings Market?

United States is experiencing growth at a CAGR of 9.2%, supported by adoption of bio-based coatings to reduce environmental impact while maintaining performance on commercial and military aircraft. Airlines and aerospace OEMs are applying coatings on fuselage, wings, and tail sections to provide corrosion protection, UV resistance, and aesthetic performance using sustainable, bio-derived materials. Demand is concentrated in airline hubs, MRO centers, and aerospace manufacturing facilities. Investments focus on coating formulation, material durability, and application precision rather than fleet expansion. Growth reflects increasing regulatory pressure, sustainability initiatives, and adoption of environmentally friendly surface technologies that meet both operational and ecological requirements.

- Airlines and OEMs drive adoption.

- Fuselage, wings, and tail sections are primary applications.

- Airline hubs and MRO centers concentrate demand.

- Coating formulation and durability guide investment.

Who Competes in the Bio based Aircraft Coatings Market and What Defines Their Capabilities?

…

Similar microanalyses of Korea, PRC, UK, Brazil

Who Competes in the Bio based Aircraft Coatings Market and What Defines Their Capabilities?

…

Key Players in the Bio-based Aircraft Coatings Market

- AkzoNobel

- PPG Industries

- Sherwin-Williams

- BASF

- Henkel

- Mankiewicz

- Arkema

- Solvay

- Dow

- Axalta

…